Why Is Time Tracking Essential for Audit Readiness?

Audits come in all shapes and sizes, from financial to operational, data security, and more. The one thing they all have in common is that they require you to have full documentation ready to show the auditors.

Fortunately, we live in a modern world where it’s easy to implement robust systems that efficiently gather and store the information that auditors commonly require.

Time-tracking is a critical component of complying with the terms of government contracts.

It’s so essential, in fact, that it’s required by law. The Defense Contract Audit Agency (DCAA) is the main body that carries out audits for government contractors. They mandate that you track all your staff’s time. They also require you to have an adequate system in place for doing this.

This is where a digital time-tracking system (as opposed to a manual one) can save you time and effort and help you successfully pass each audit.

My Hours Features for Audit Preparation

The My Hours time-tracking app has everything you need to succeed in audit readiness. The platform follows ALL DCAA guidelines to ensure that your business has the tools to create a complete paper trail of time and money spent.

A Complete Time-Tracking Solution

To pass an audit, there must be no gaps or inconsistencies in the timesheet data. Despite having reliable staff, it’s still common for people to forget what they have done or make genuine mistakes.

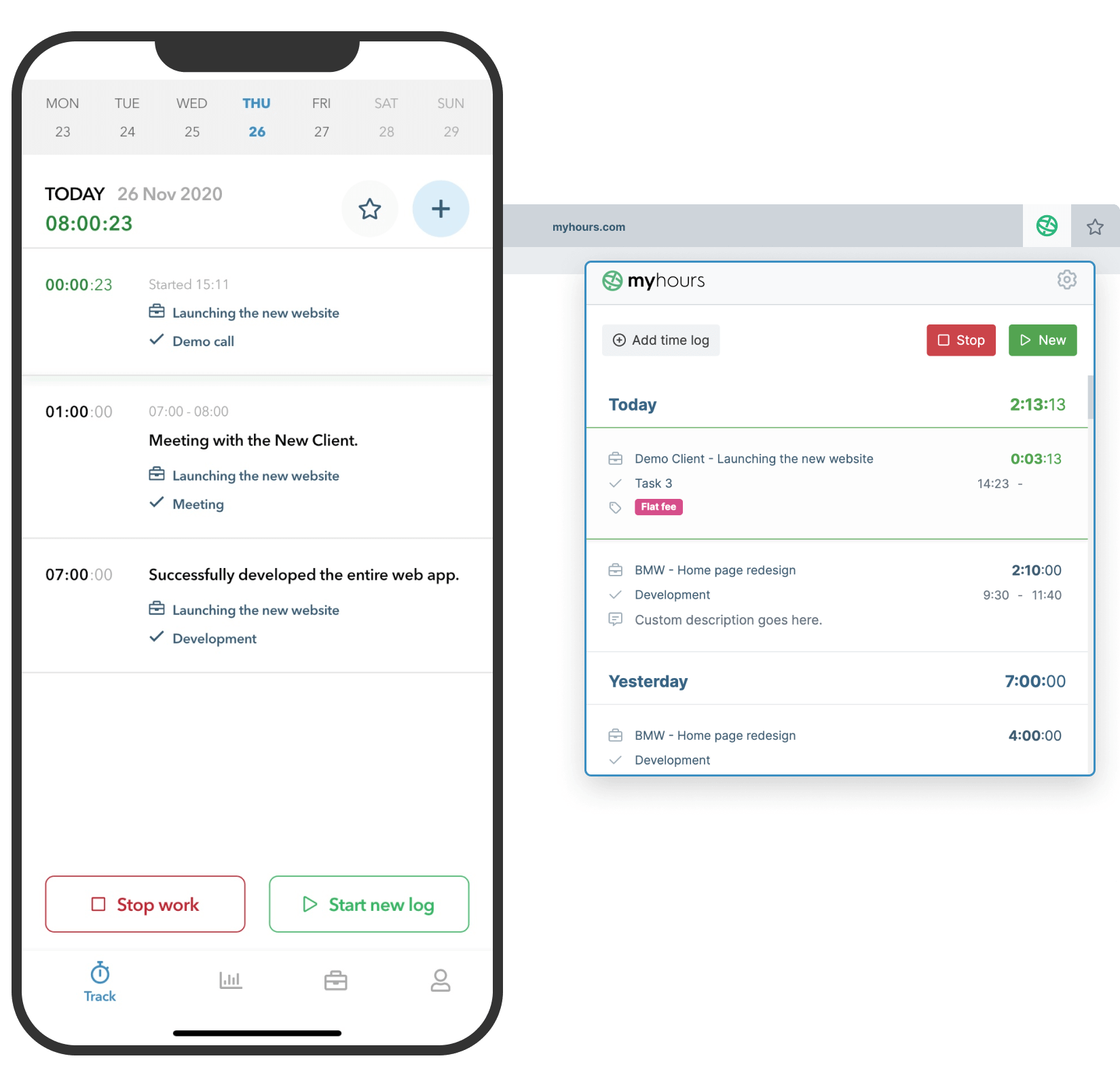

My Hours has taken this into account and provides several convenient ways for staff to track their time.

First, there are the standard timesheets that staff can regularly fill in. The system is designed to make this job fast and convenient:

- Timesheets can be split by projects and/or tasks to show exactly where time was spent.

- Staff can add detailed descriptions to each time log.

- For tasks that repeat (weekly admin, for example) it is possible to copy them into new time logs.

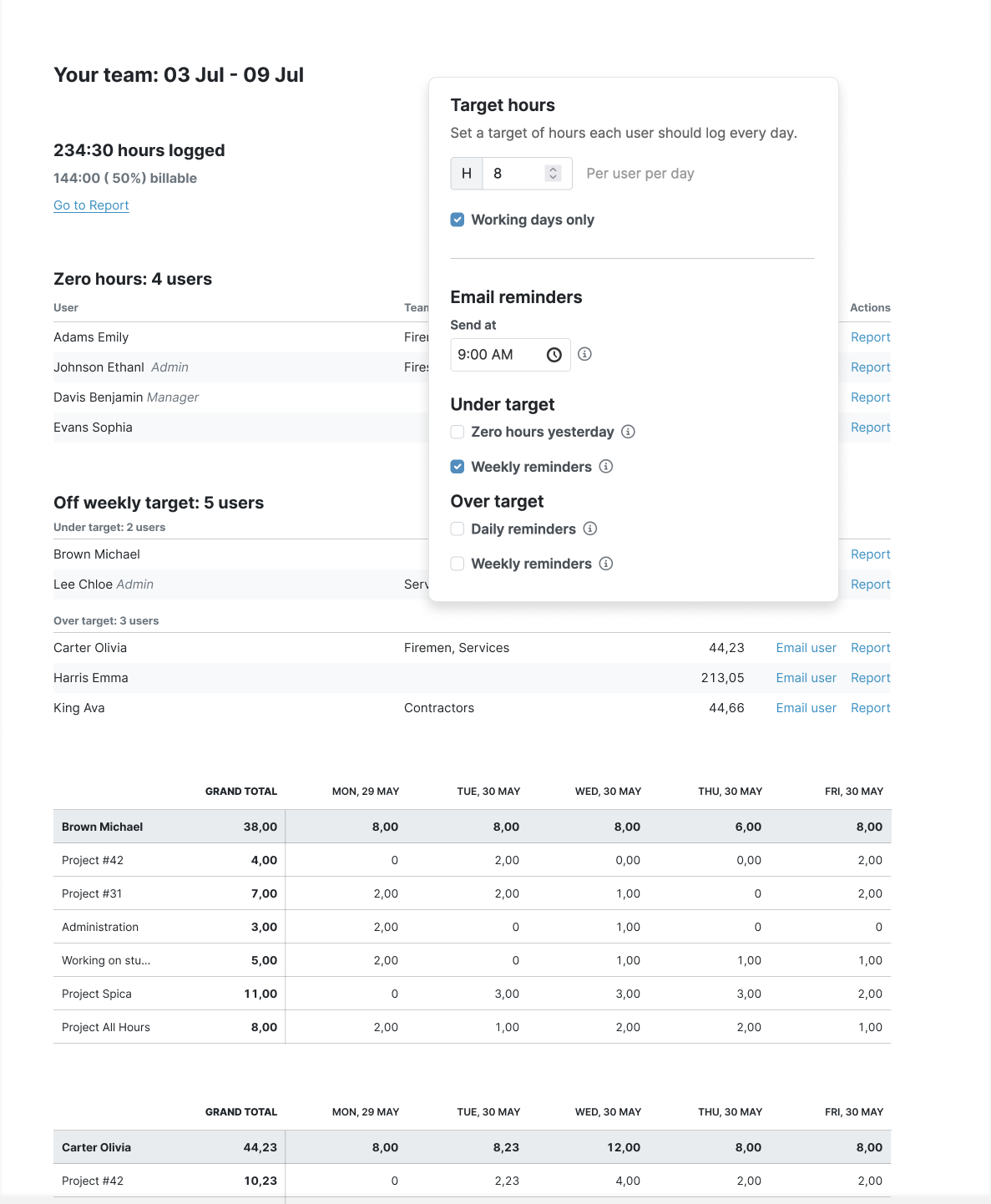

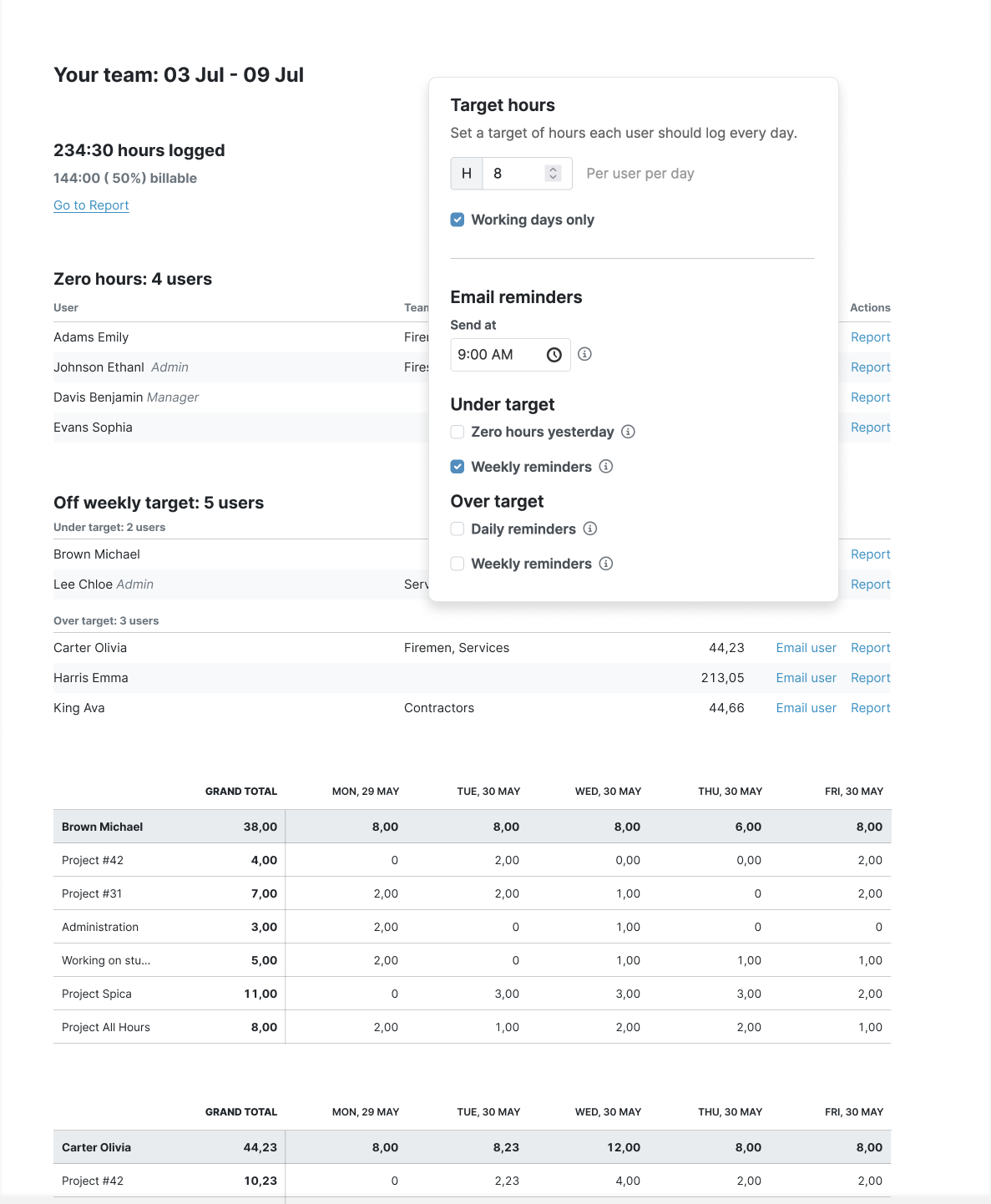

- Staff who fail to submit their timesheets can be sent reminders on a weekly or daily basis.

An even faster (and more accurate) solution for many is the real-time time tracking capabilities. This stopwatch-based feature can be used to track time down to the last second and helps prevent staff from forgetting how long they worked on a task.

The Android and iOS mobile app is another incredibly useful feature for tracking time, especially if you employ remote staff or have staff who need to travel often. This means time can be tracked while on the go which goes a long way toward preventing forgotten or inaccurate time logs.

Prevent Gaps and Inaccuracies

Despite the multiple time-tracking methods, data inaccuracies are bound to crop up.

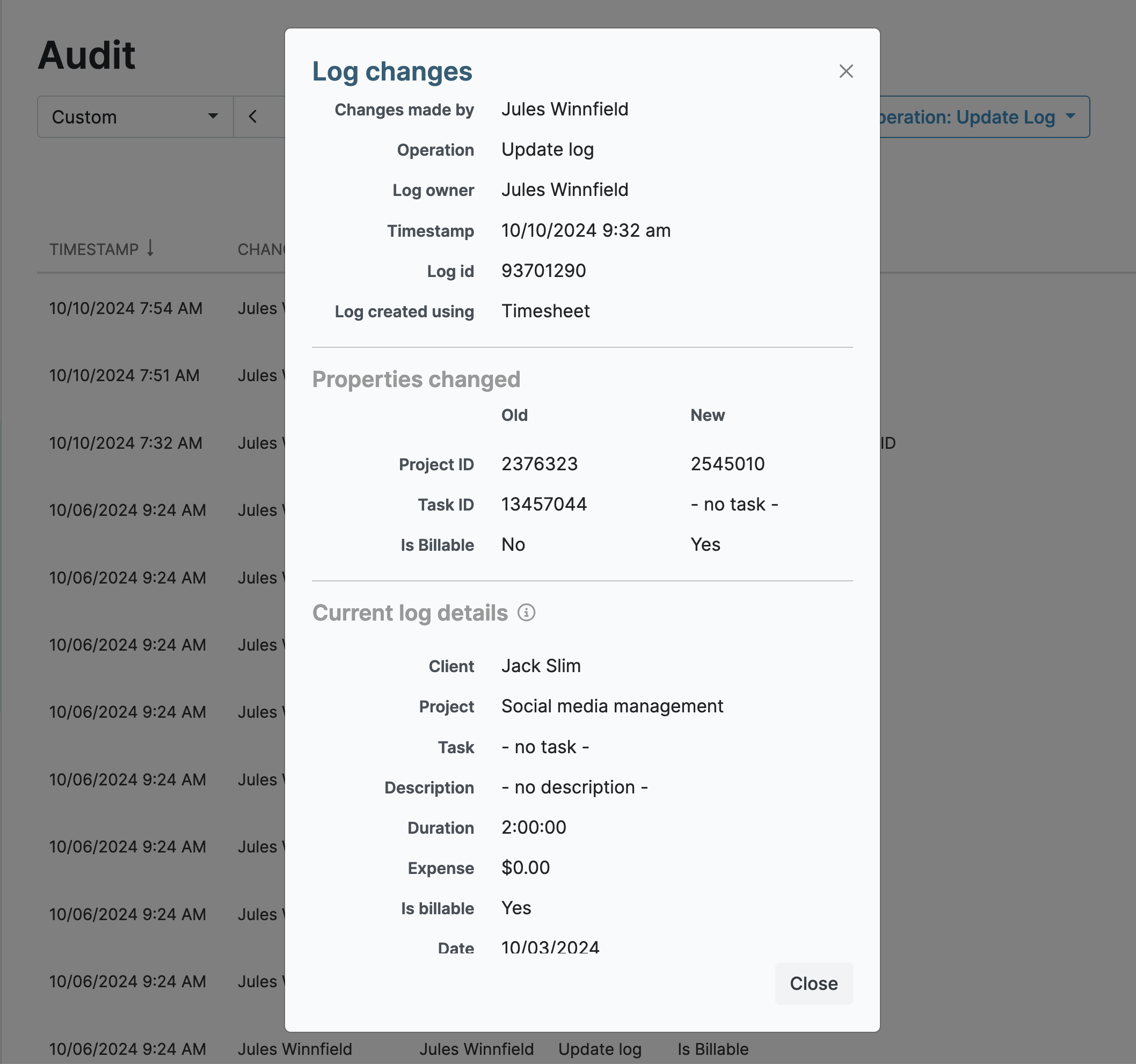

This is something your supervisors need to rectify as and when the timesheets are submitted. Otherwise, there’s going to be a whole lot of backtracking when the inaccuracies are picked up during an audit.

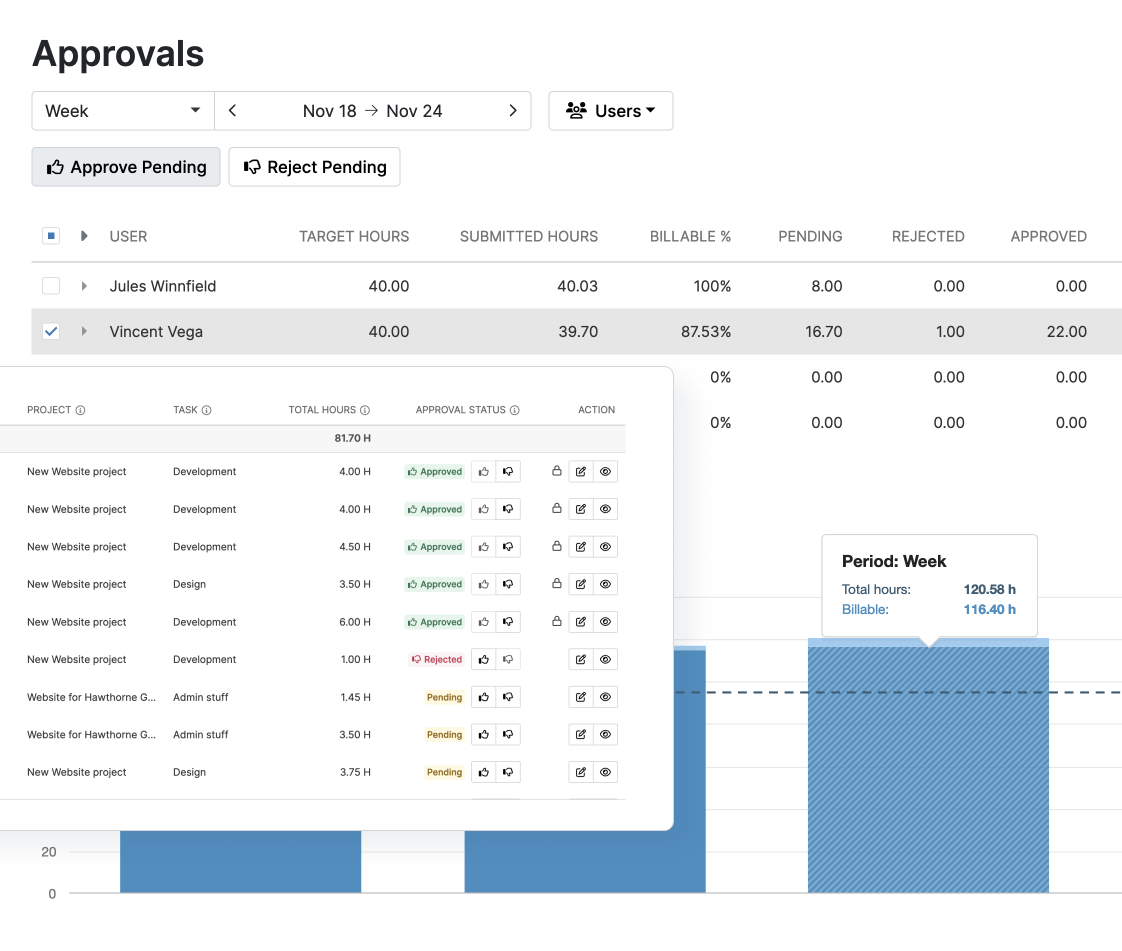

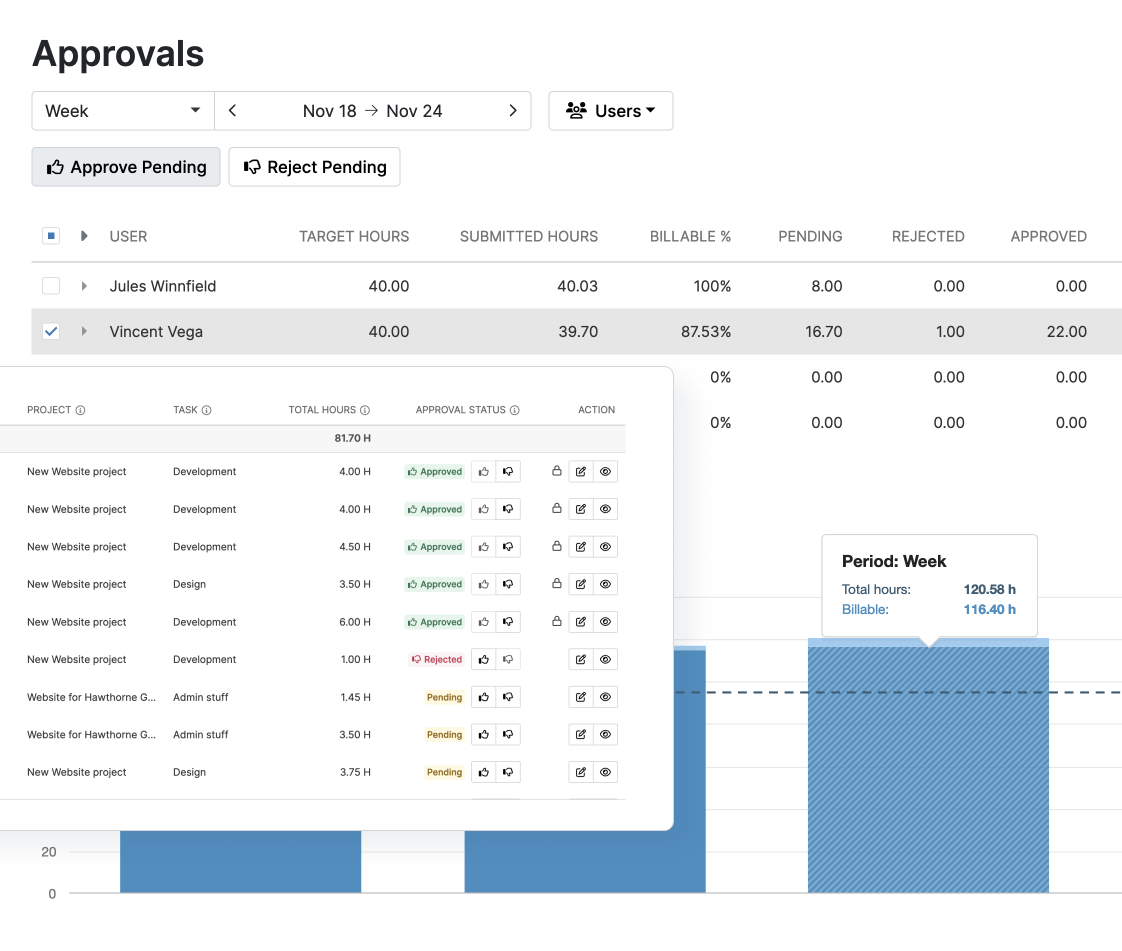

To prevent this, My Hours lets you set up an automated approval process for timesheet submissions:

- When a timesheet is submitted, the relevant supervisor will automatically receive a message via email.

- After checking the data, they can “reject” or “approve” simply by replying to the message.

- For rejected timesheets, the staff member can make the corrections and resubmit.

- Once a timesheet has been approved, it is then “locked,” and no further edits can be made.

It is possible to set up multiple approvals if needed.

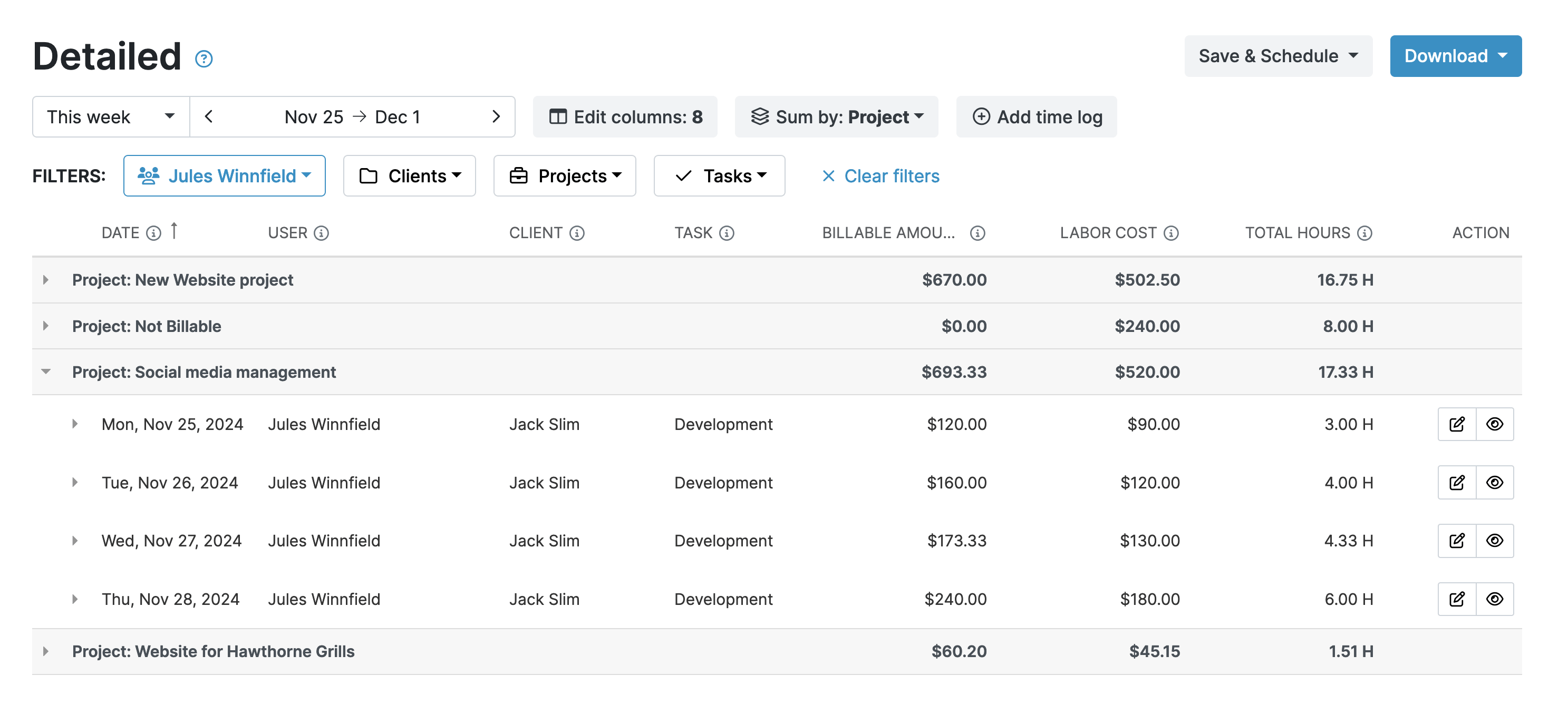

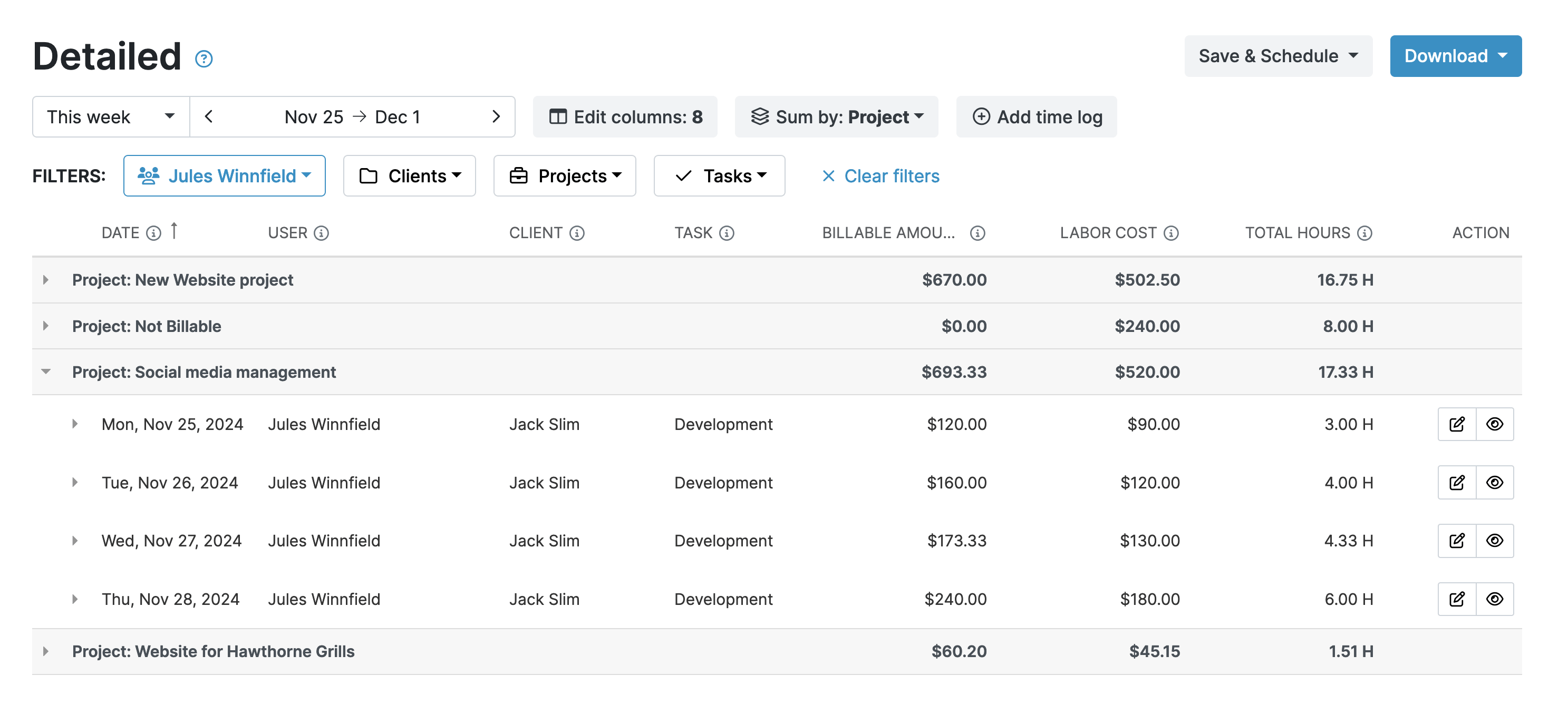

Breaking the budgets down to the task level gives you access to important insights. You can pull the historical data into a detailed report and compare the results with your estimated budgets. Additionally, the detailed report features customizable columns and filters so you can get exactly the data you need.

Tax Credit Maximization

R&D tax credits are an incentive worth going for. The savings are significant but the claims process is complex.

One requirement for claiming R&D tax credits is to have accurate accounts of time and money spent on activities. Without this information, your claim will be denied.

Using My Hours to track everything will ensure you have the required information to hand when tax season rolls around. And, to prevent gaps or inaccuracies in the data, My Hours has made it as convenient as possible for your workforce to track their time:

- Staff can complete their timesheets manually or by using the real-time time-tracking feature.

- There’s a My Hours Android or iOS app that allows time and expense tracking from any location.

- The Chrome and Edge browser extensions track time without having to have the My Hours app open all the time.

Timesheets can be submitted daily or weekly, and you can set up automatic reminders within My Hours to remind staff that their timesheets are due. This really helps stop data gaps because it prevents staff from forgetting to complete the information.

When tax season looms, all you have to do is pull a report with the required information. There’s no lengthy preparation process—you just have to click a button!

Effective Resource Management

A big part of staying within budget comes down to effective resource management. And it’s very difficult to do this without solid data to analyze.

The real-time time-tracking feature in My Hours is integral to managing resources because it shows precisely how much time is spent on each R&D project and task.

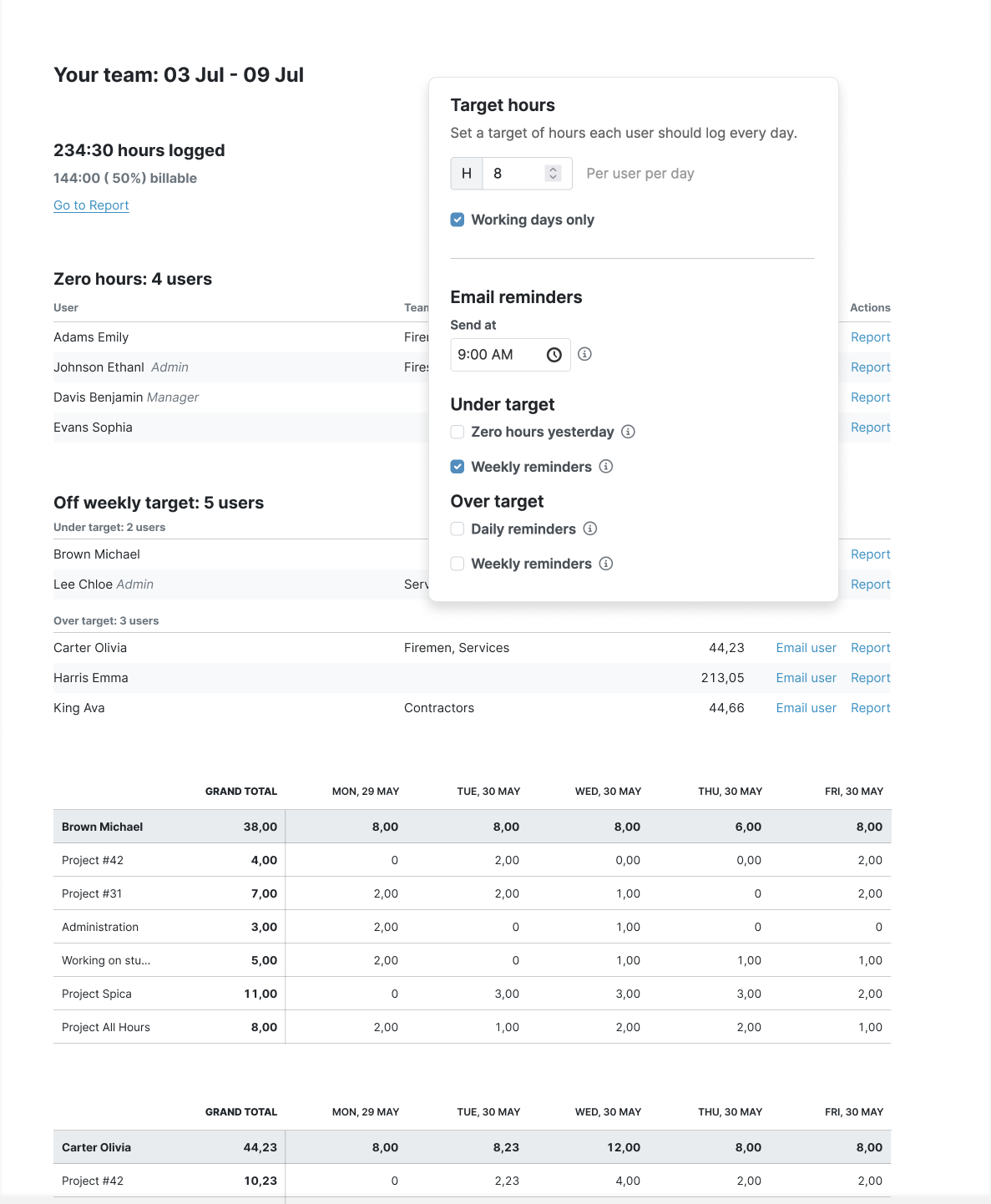

To gain even more accuracy, you can set up different teams within the platform. That way, the time data is not only collected at the individual level, but it also shows how each department within R&D is collectively spending its time.

Clocking too much overtime is a surefire sign that there is a resource management issue. To understand if this is happening, you can set daily target hours in My Hours. Doing this will notify staff when they have tracked sufficient time for the day or week (and help prevent them from racking up too many hours).

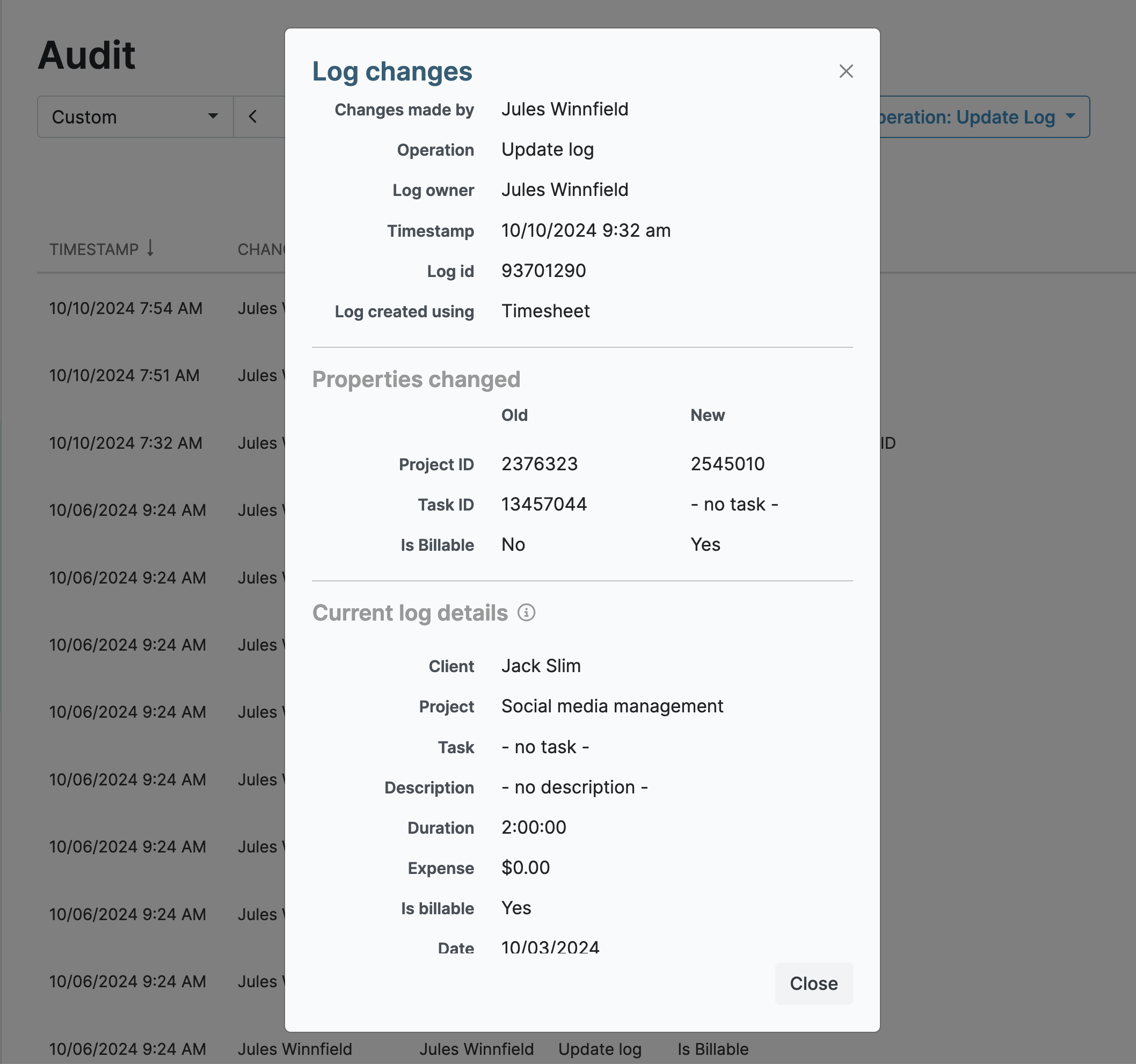

Perhaps most importantly, every single timesheet change and edit is logged within theMy Hours Audit log report. What this does is provide you (and auditors) with a clear and transparent paper trail of everything that has taken place within the app.

Accurate Expense Tracking and Billing

It’s not just time that auditors (and the law) want you to track. Government contracts involve the expenditure of public money, so every penny must be accounted for. You must also show auditors that you are only billing the government for allowable expenses.

Allowable costs include:

- Staff wages and salaries

- Overheads

- Materials and equipment

- General and administrative costs (payroll, HR, etc.)

If you include anything outside this scope in your invoices, then you can pretty much guarantee to receive an audit.

Fortunately, My Hours contains all the features you need to keep track of all allowable expenses.

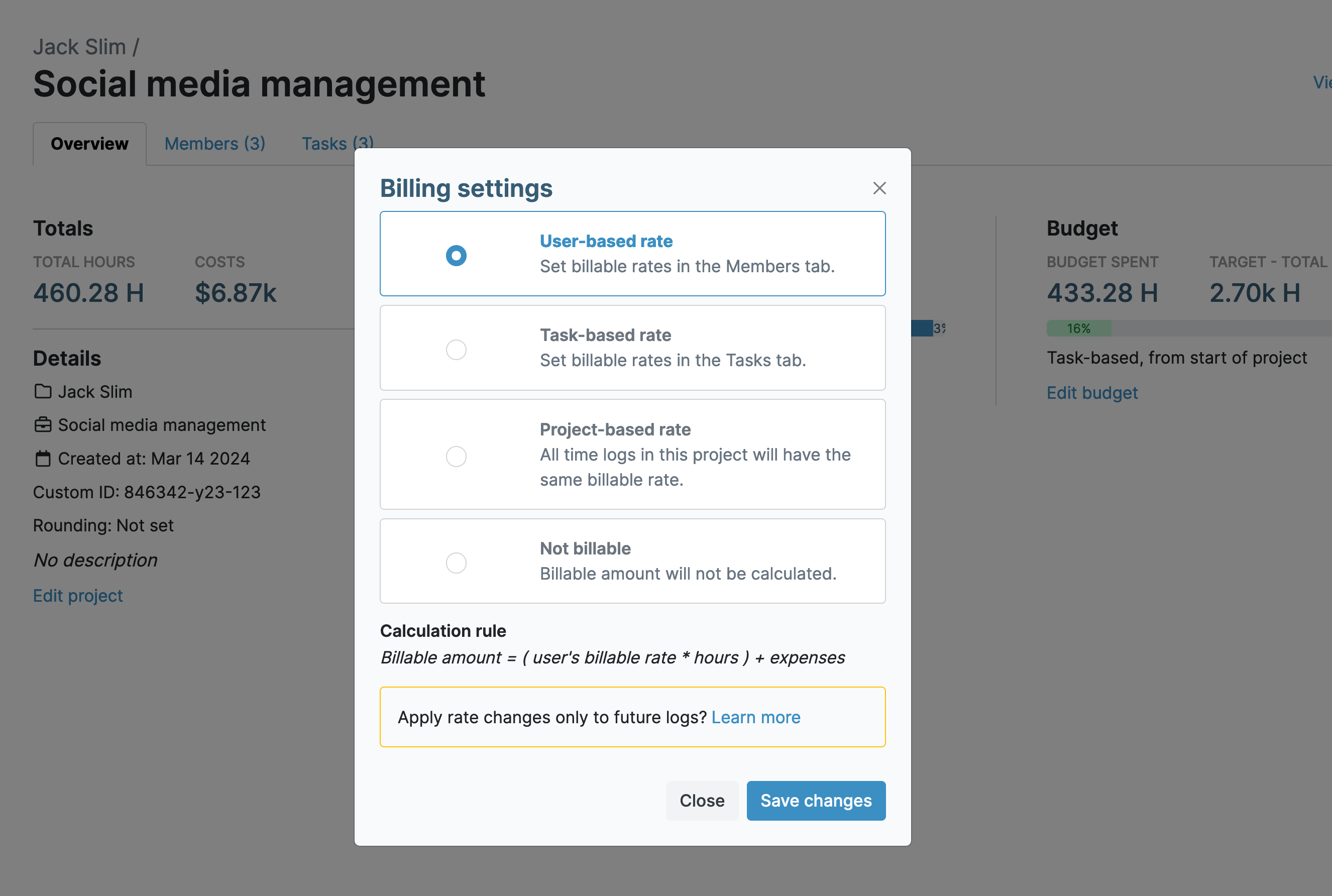

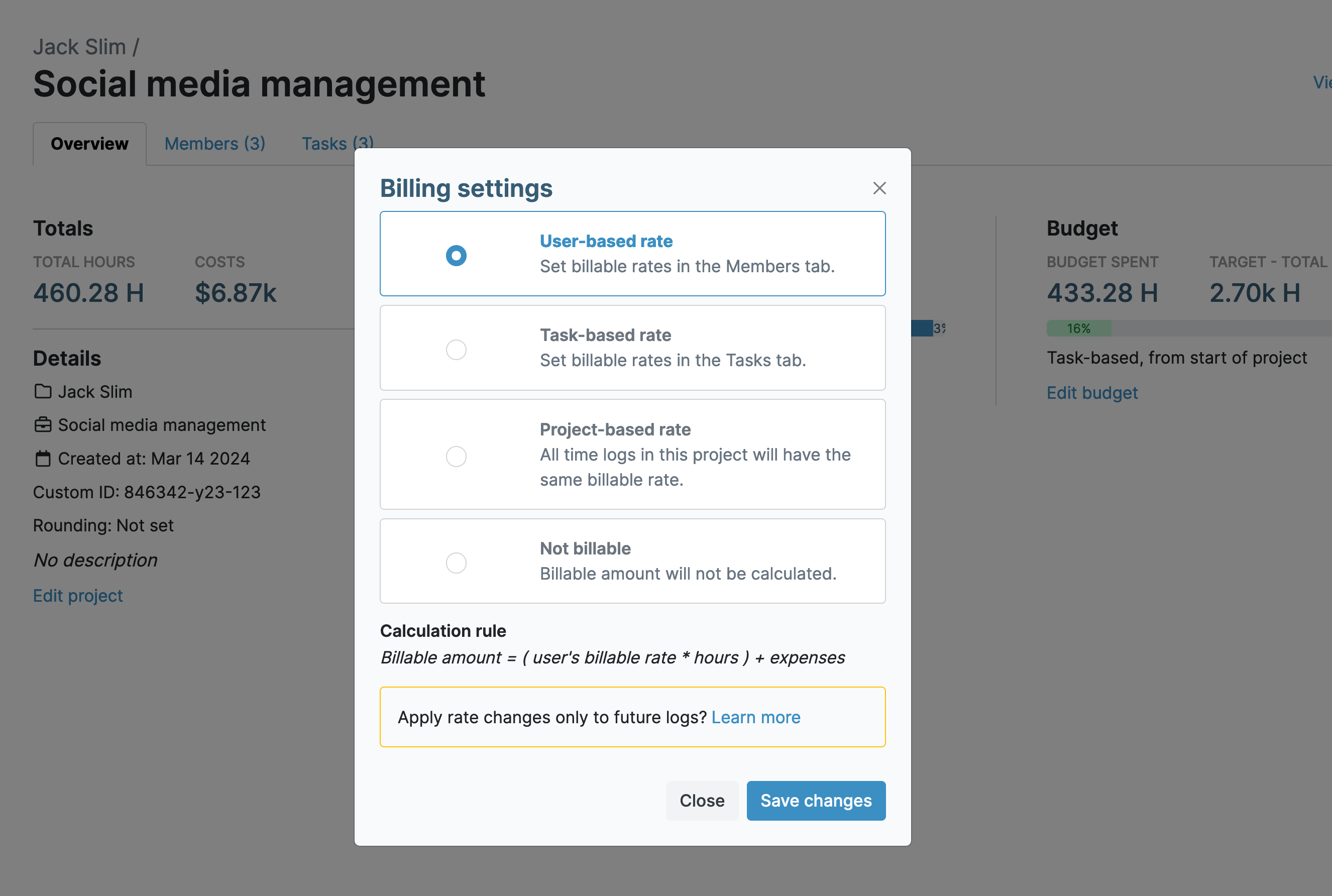

First, you can assign billable rates. These are:

- Hourly billable rates per staff member

- Hourly billable rates per project or staff

- Fixed daily or weekly rates

- Fixed project fee

With these flexible options, you can pick the one that suits your contract type the best and ensure accurate and fair billing.

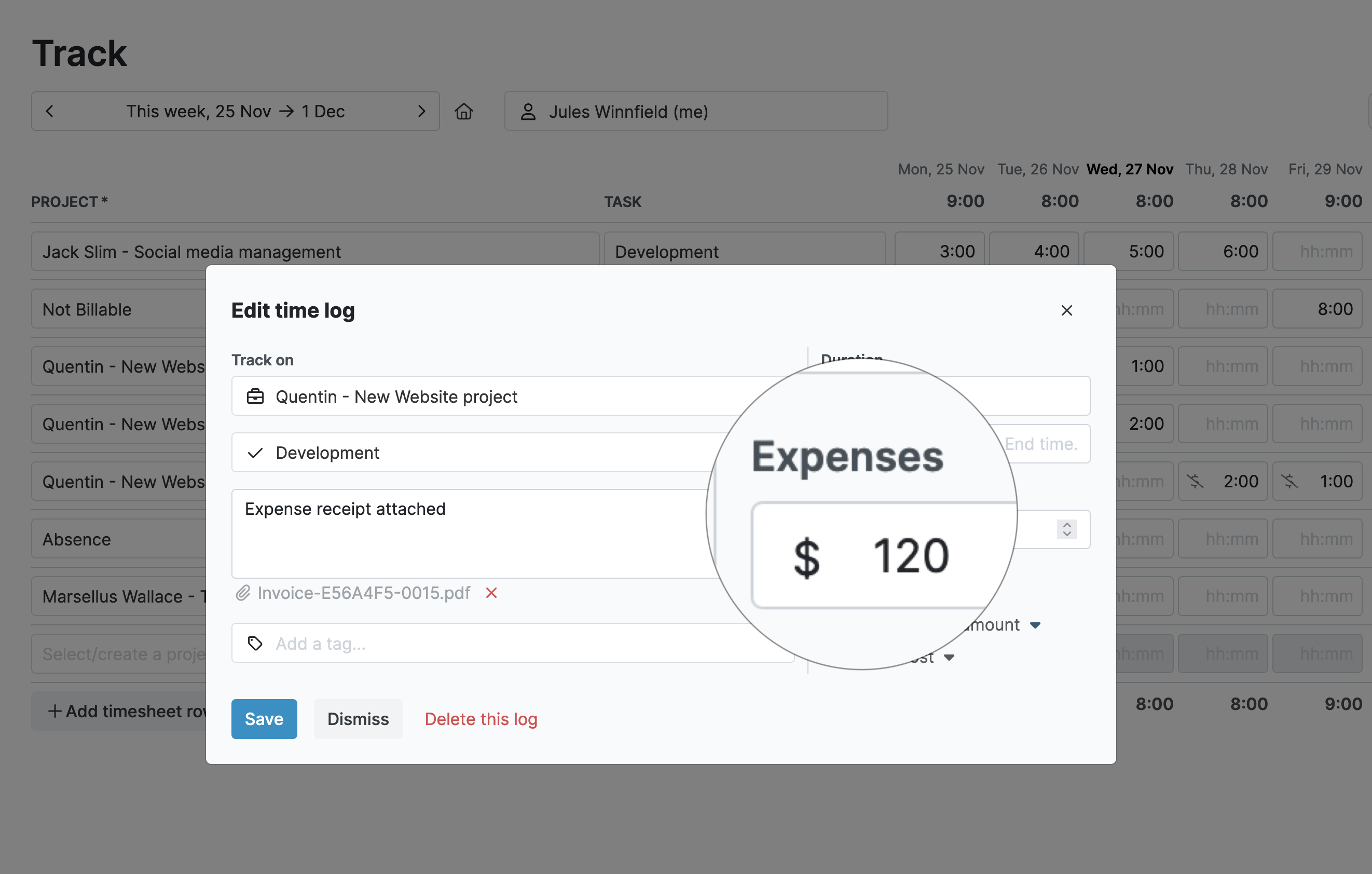

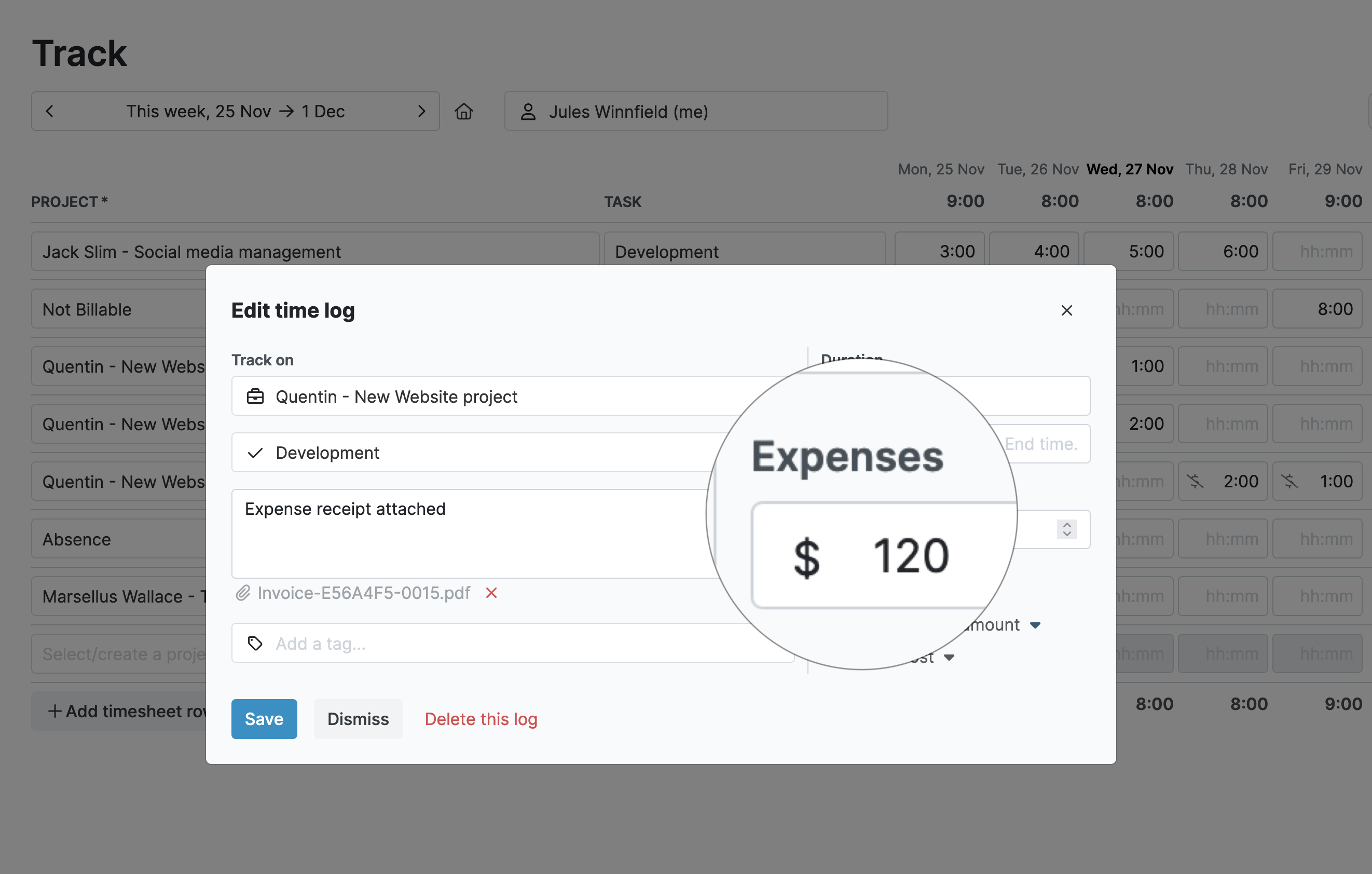

Expense tracking is also a prominent feature of My Hours. It allows you to create expense categories by project, task, or tag. As expenses are logged, receipts and invoices can be uploaded, which provides auditors with the necessary proof of expenditure.

If you want to track ALL expenses in My Hours (including unallowable costs), simply create tags for allowable and unallowable and assign the appropriate one to each expense. When the time comes to send an invoice, you can filter out the unallowable costs and only bill the government for what you are allowed.

Effective Budget Management

Auditors want to see that you are efficiently managing your budgets.

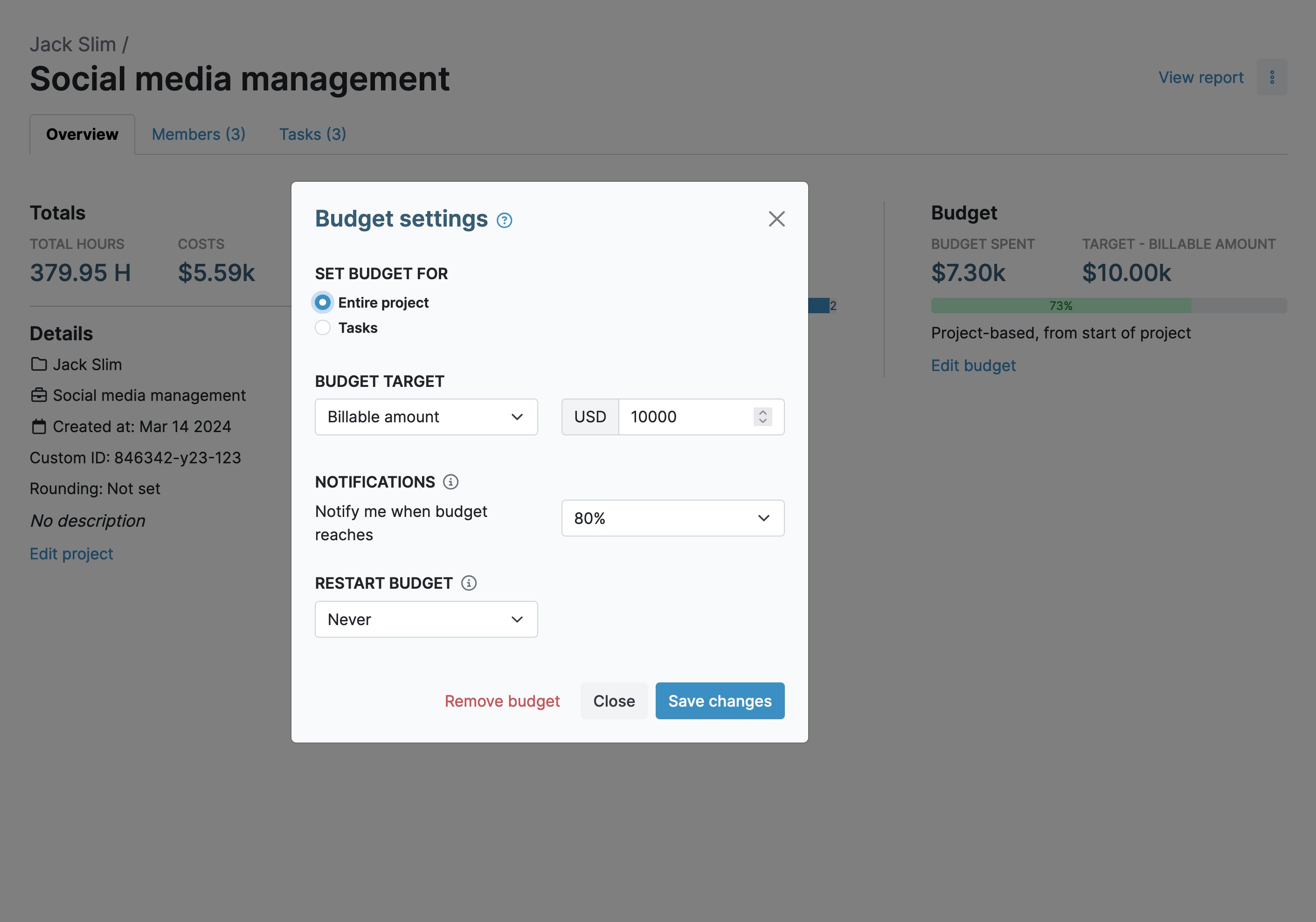

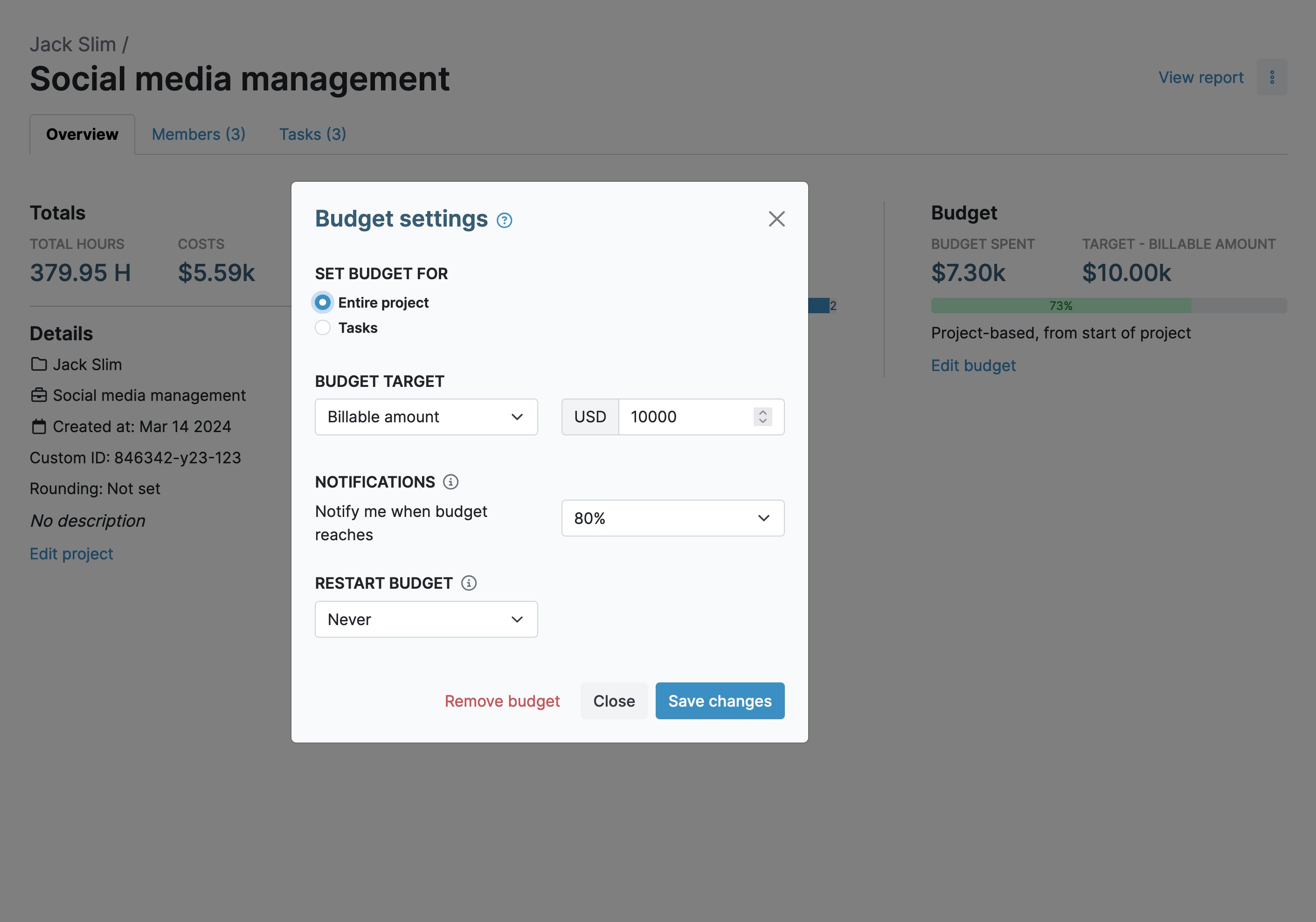

You can set a budget for each of your projects and tasks. To help you stay on track, ask My Hours to automatically notify you once a certain percentage of the budget has been spent.

You can also control overtime expenditure by setting a weekly maximum number of hours that staff should work. Once a staff member reaches this threshold, My Hours will notify them that they are about to go into overtime.

Auditors are also keen to understand how you optimize spending.

For this, you can use historical data to identify trends, inefficiencies, and issues.

Flexible Reporting Methods

The beauty of My Hours is that it keeps your organization’s time and cost-tracking data in one single place. Everything is available at the click of a button.

The flexible reporting methods mean you can show auditors precisely what they want to see, with little to no effort on your part.

1. The detailed report gives you the most flexibility. You can use this one to essentially show whatever data you want.some text

- Use the filters to customize and display specific data in granular detail

- Save the report settings to make future audit preparedness even faster

2. Dashboard reports provide illustrated overviews of the most important data.some text

- Use this report when you are not interested in details of specific time logs, but rather in the big picture

3. Timesheet reports organize your data in a table grid.

- check how the time and costs of your Team's work were distributed across different days, clients, projects, and/or tasks

Reports are available in PDF format, which includes illustrated graphs. If the auditors want a detailed report, you can easily export the data into XLS format.

What Are the Consequences of Failing an Audit?

With the right tools and the proper management of your organization’s time and money, you are unlikely to fail an audit.

However, if you fail to implement the necessary systems and processes, the consequences can be severe. If your contract audit is unsuccessful, one or more of the following might happen:

- You can lose your government contract and be flagged as ineligible for future contracts

- You could get fined or made to pay back money spent

- The government may begin legal proceedings or file a lawsuit

- The organization may suffer from reputational damage and loss of further business

Final Thoughts

Being prepared is key to responding to an audit request in a timely fashion. Compared with manual processes, systems like My Hours make audit preparedness fast and simple.

By leveraging such tools, you can ensure accuracy and compliance and significantly reduce the risk of negative audit outcomes.