The Challenges that Surround R&D Claims

Successfully navigating the R&D tax credit landscape isn’t easy. This is especially true for smaller businesses and startups that don’t have a team of financial experts to guide them through it.

Claims have strict deadlines and the complex process makes submitting all the information on time harder. Delays may cause you to lose out on available tax credits or have the claim denied.

One aspect of R&D tax credit claims is the requirement to account for all activities. Maintaining detailed and accurate records of R&D expenditures and time spent is crucial.

Failure to do this can also mean that your tax credit is denied. Worse still, inaccurate data could trigger an audit and increased oversight from regulatory authorities.

The answer is streamlining your data collection processes. By implementing a robust time and expense tracking system, you can ensure that your R&D department’s data is complete and error-free.

Furthermore, a proper system will give you access to the data when you need it, no matter where you are.

Why My Hours Plays a Crucial Role in Gaining R&D Tax Credits

Streamlined Time Capture

To qualify for R&D tax credits, departments must demonstrate precisely which money and resources they have spent on research projects.

One of the biggest resource expenditures is staff. Not only is their time a resource, but their salary cost counts as a resource too. This means you have to account for both.

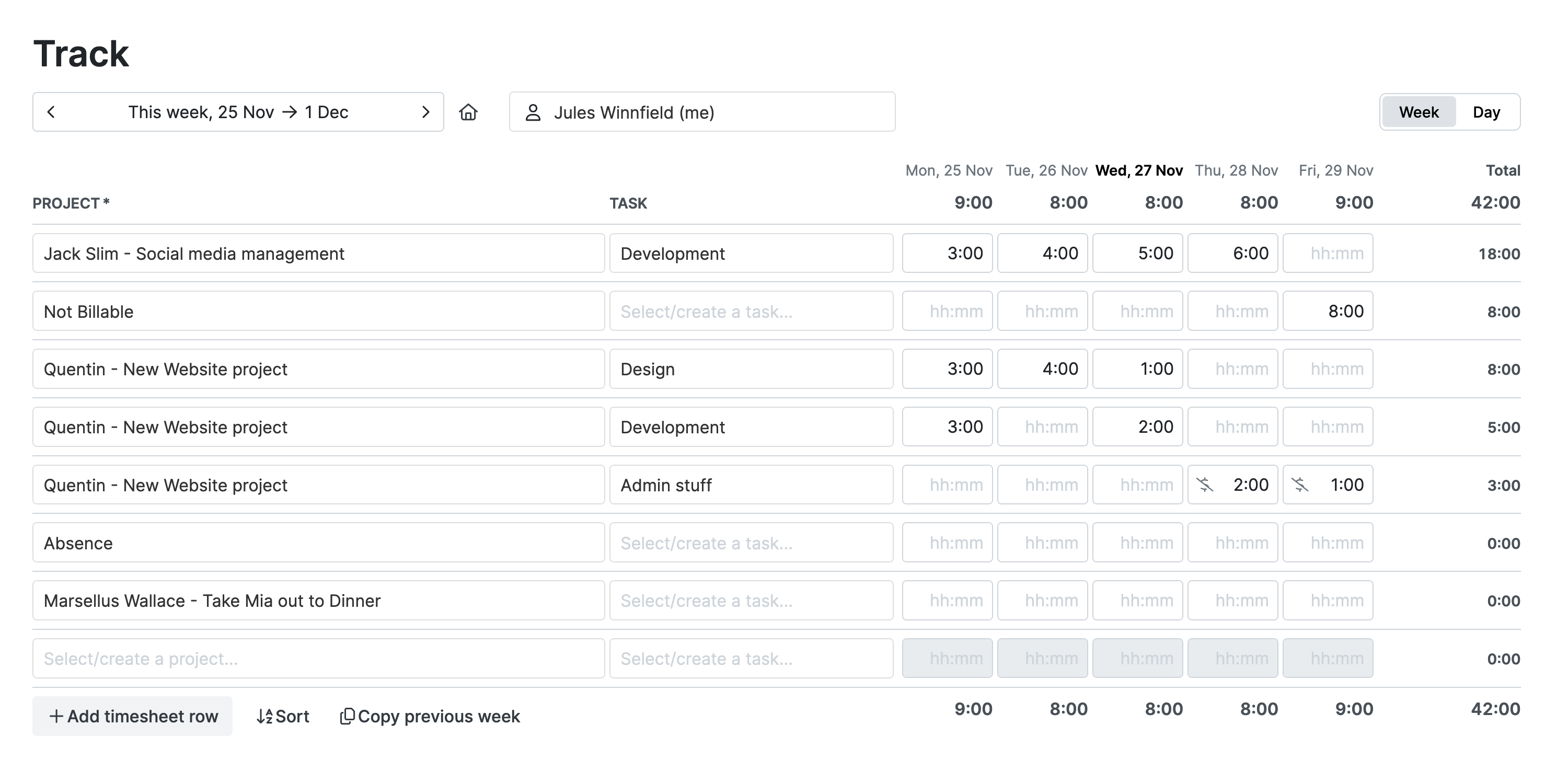

My Hours is designed to make it fast and simple to collect this data.

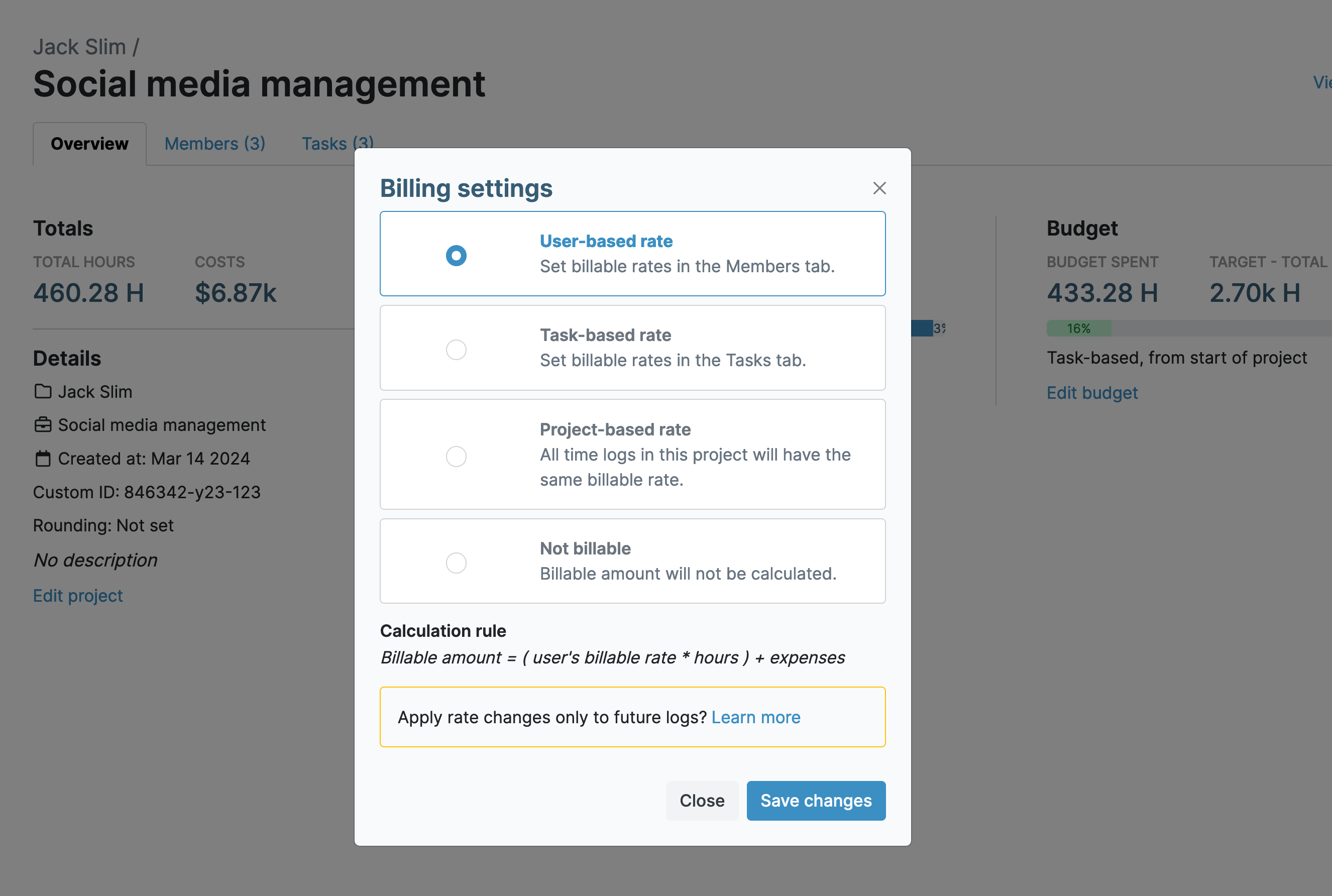

To assign employee costs, you can set an hourly rate for each staff member. Then, as soon as they start tracking their time, their cost data is also accumulated, which gives you precise information about your R&D expenditure.

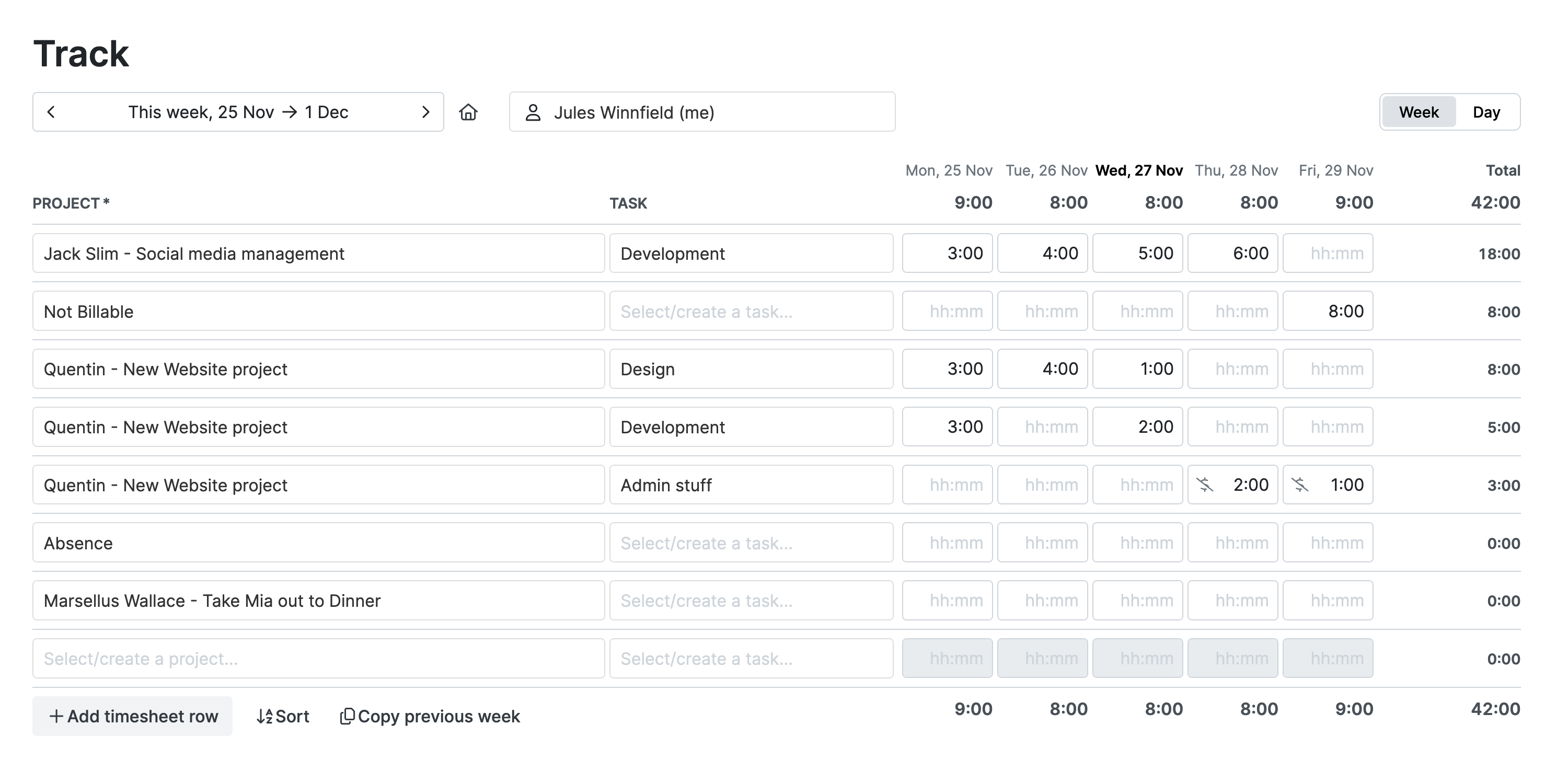

Of course, to get this information, employees have to be tracking their time properly. My Hours aims to make this as convenient as possible by providing numerous time-tracking methods:

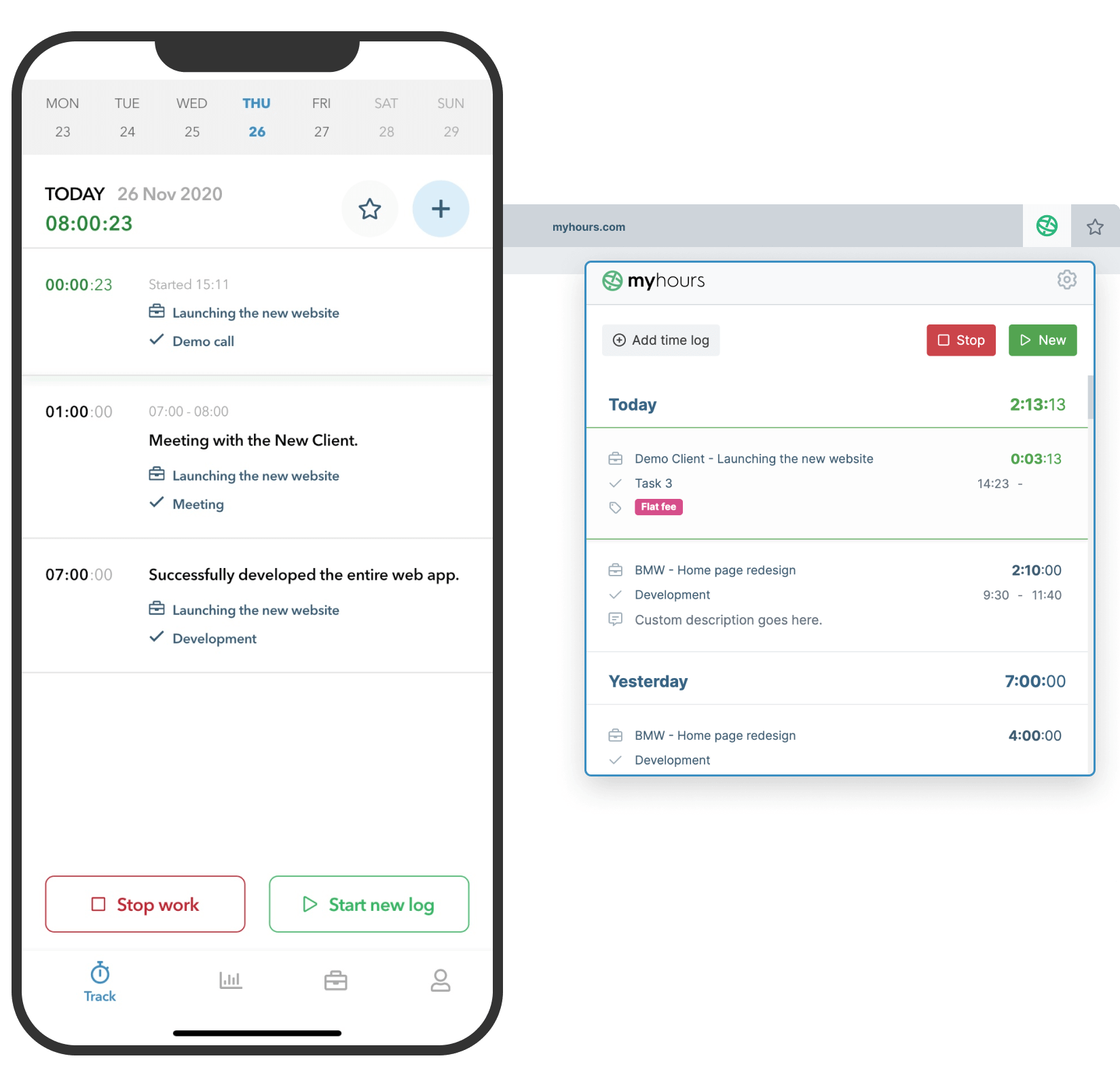

- More accurate data can be obtained by using the real-time time-tracking feature. This tracks time to the exact second. It’s also an excellent tool for those who tend to forget where they have spent time.

- The My Hours Chrome and Edge browser extensions allow time-tracking without having to have a browser tab open specifically for the My Hours app.

- Finally—and perhaps the easiest way to track time—is the My Hours mobile app. This handy tool allows time to be tracked from anywhere, no matter what your staff are working on.

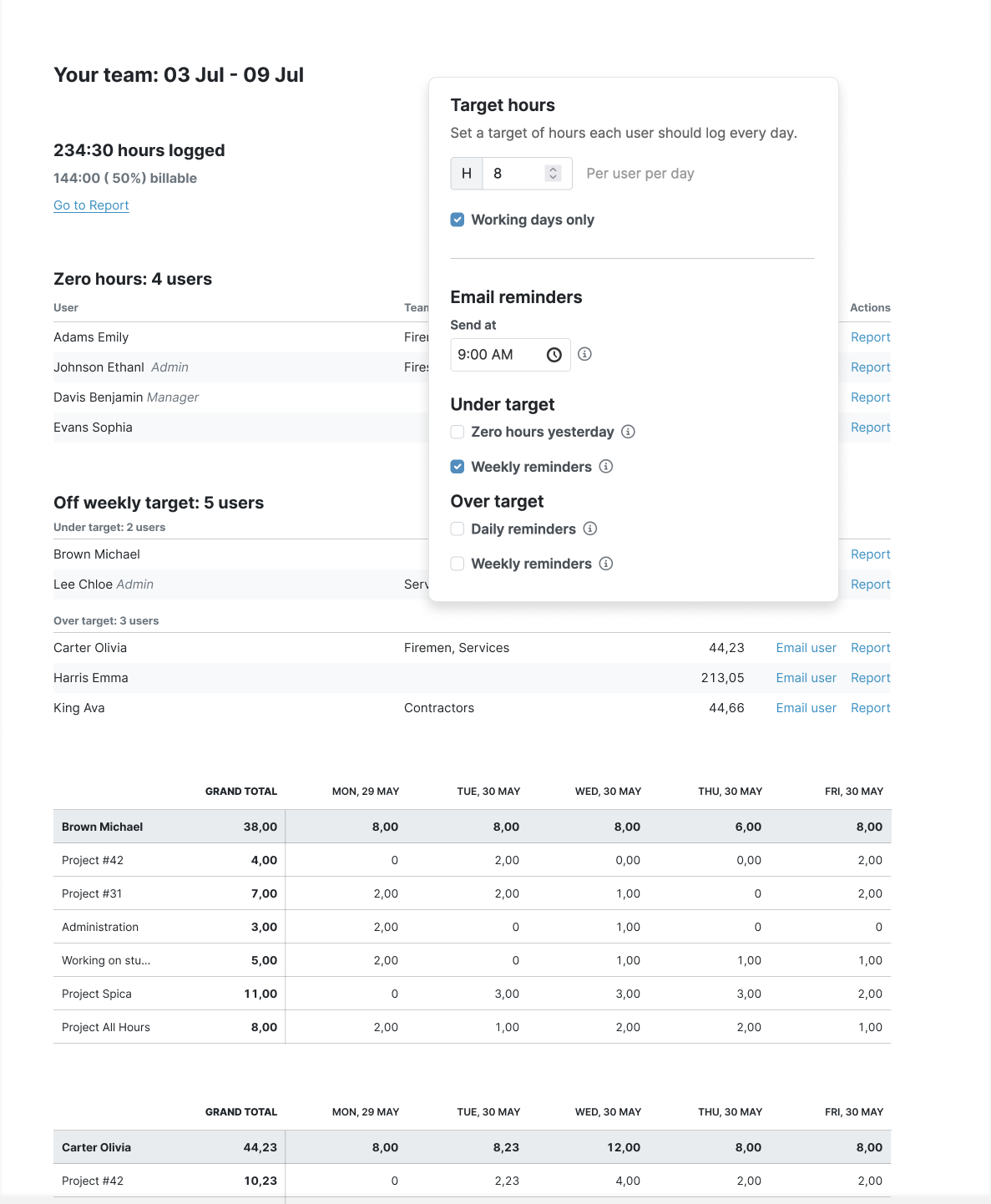

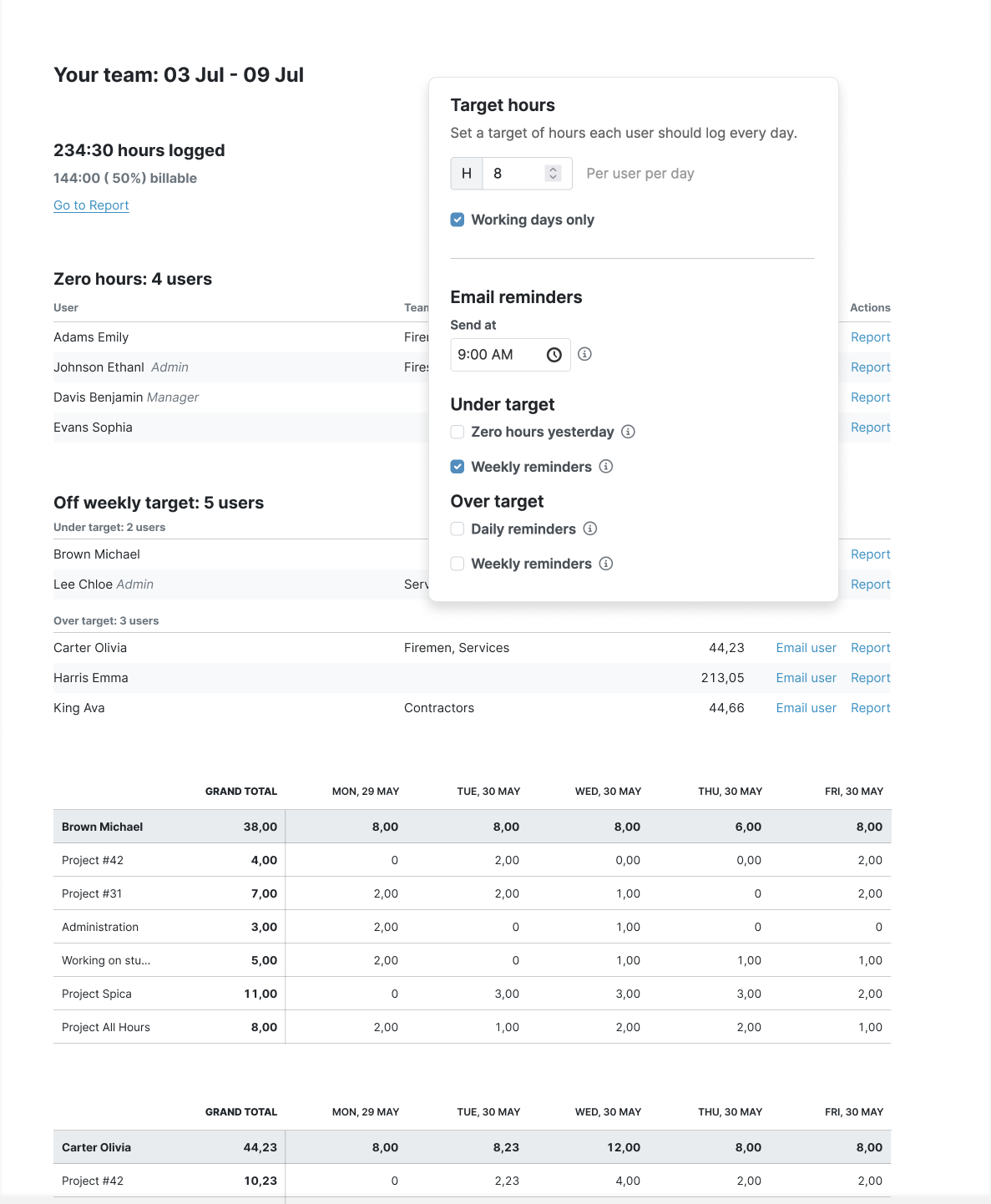

Gaps in the time data are not an option if you want to successfully claim your R&D tax credits (which, of course, you do!). Hence, you will find these additional My Hours features extremely useful:

- Set up automatic daily or weekly reminders which prompt staff to complete their timesheets.

- Create an automated timesheet approval process so supervisors can check the data and send it back to the staff member if there is incorrect or missing information.

- Once timesheets have been approved they are locked. This prevents anyone from going back and making additional changes and skewing the data.

Project and Task-Specific

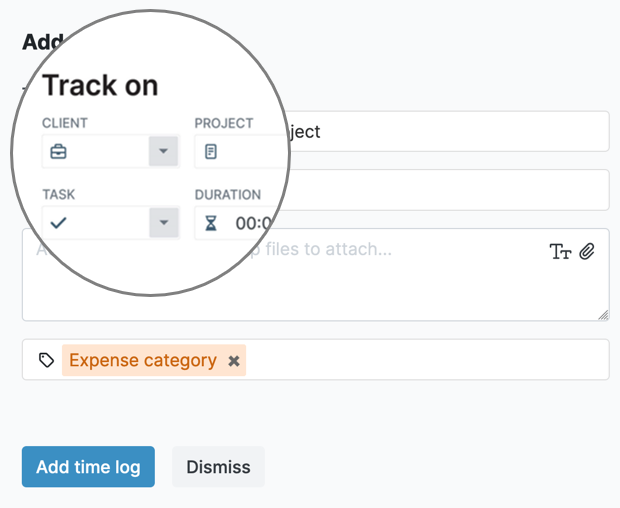

Tracking time alone isn’t enough to satisfy the criteria for claiming R&D tax credits. You must also ensure it’s tracked in the right places.

To enable this, you can set up clients, projects, and tasks within the My Hours app. This allows you to break large R&D initiatives down into smaller sections and demonstrate exactly where the time is spent.

For example, you can set up a client in My Hours:

- large R&D initiative for pharmaceutical drug development,

then break it up into smaller projects such as:

- compound synthesis,

- preclinical,

- formulation development, and so on.

Then, within each project, set up tasks that record the individual activities your staff members are working on.

Doing this keeps the costs and time-tracking completely separate from each large R&D initiative (important for claiming tax credits). You also get the level of detail required to prove that every minute is tied to specific R&D efforts.

Precise Cost Categorization

Without verifiable cost data, you won’t stand a chance of claiming R&D tax credits, while incomplete data can mean you don’t get the maximum you are entitled to.

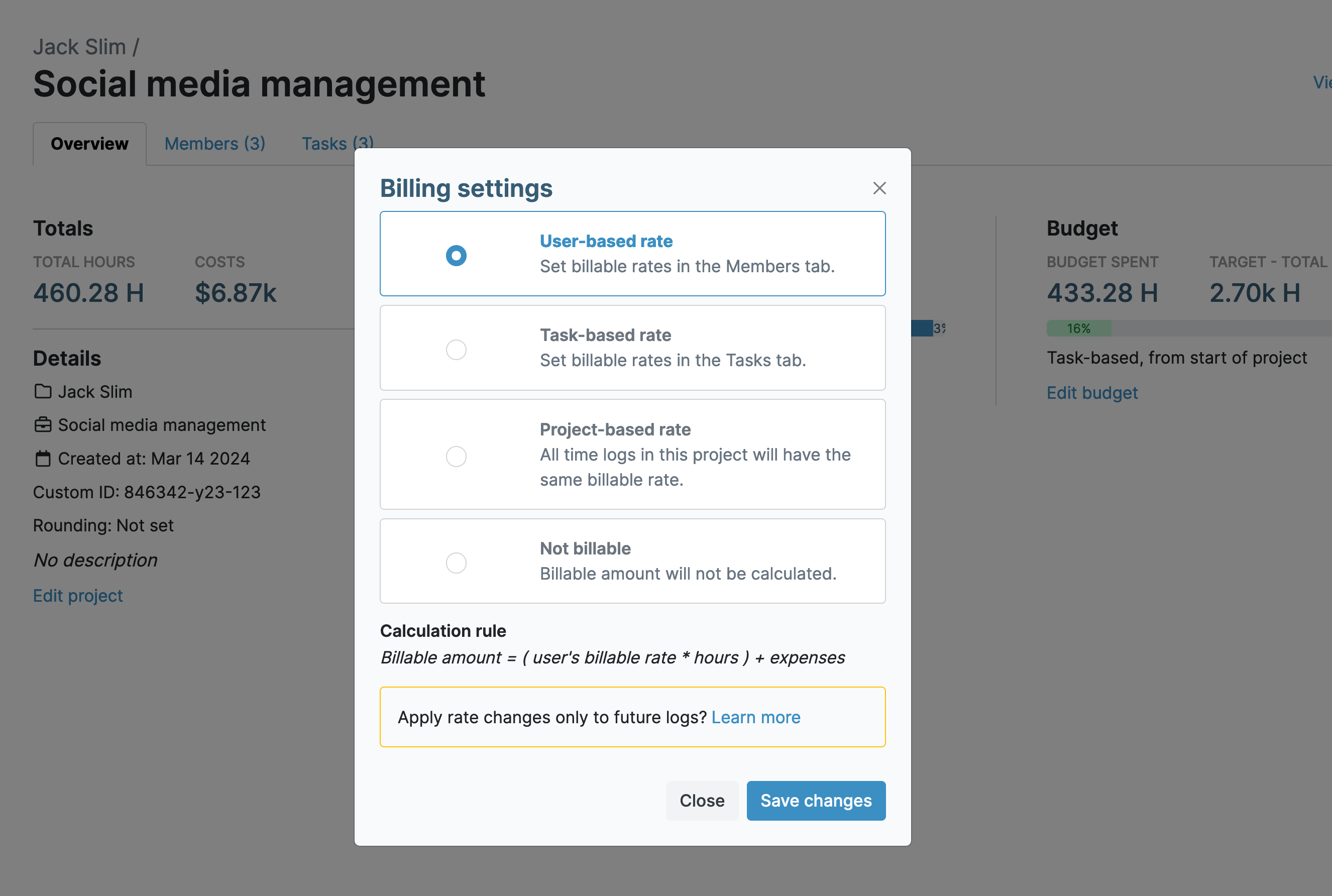

We’ve already talked about how you can assign cost rates to your staff members in My Hours. These rates can then be tracked against the budgets that you set.

Budget setting is flexible—budgets can be assigned at the project or task level. You also have the option to get automated reminders once a certain percentage of the budget is spent, which helps you stay on top of expenditures.

Staff costs are just a small part of R&D expenses, though. What about other expenses such as equipment, overheads, supplies, etc.?

Tax authorities have very clear rules on what constitutes “allowable” and “unallowable” expenses for R&D. In other words, you can’t claim the tax credits for ALL your R&D expenditures.

For example, the Internal Revenue Service (IRS) in the US categorizes allowable expenses as:

- Staff wages within R&D departments

- Third-party costs to contractors who perform qualified activities

- Required supplies and equipment for R&D activities

- Research expenses to education and scientific institutions

Some of the unallowable expenses include:

- Market research

- Overhead costs (electricity, water, etc.)

- Research costs that have already been funded by grants or other means

- Research performed outside the

Tracking costs within your projects is essential to maintain clarity on your allowable and unallowable expenses.

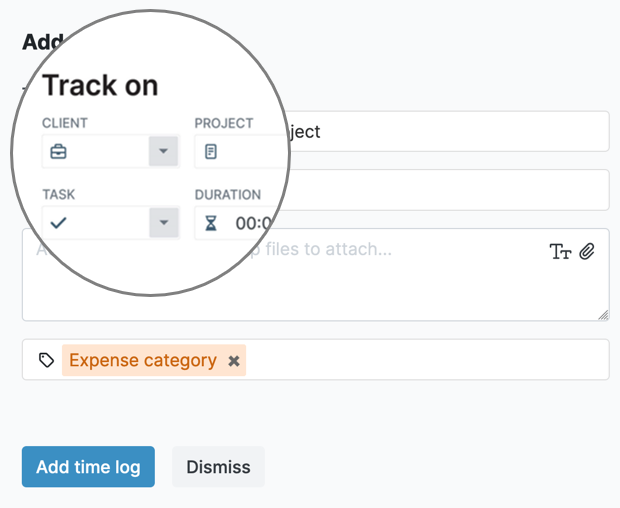

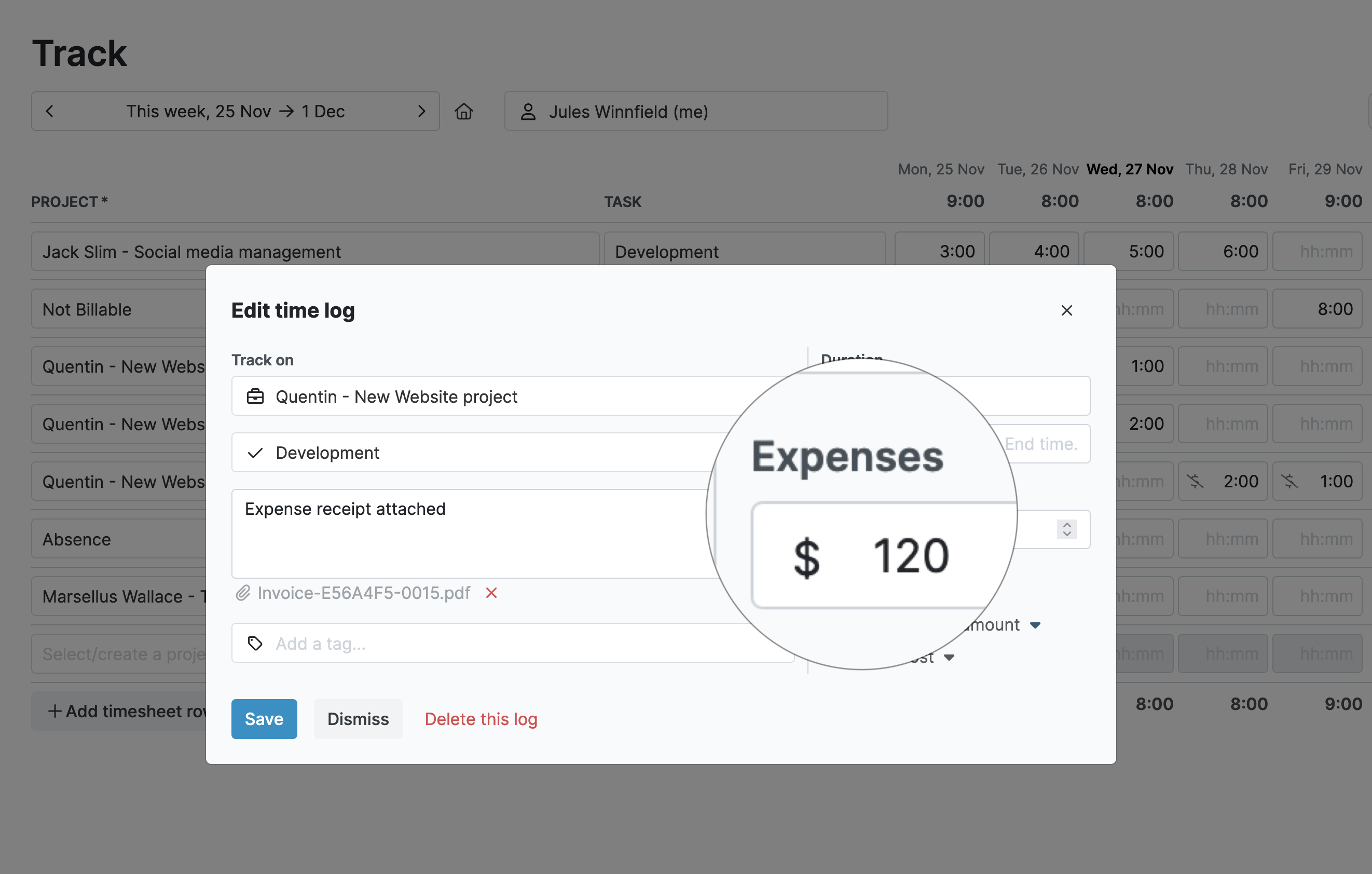

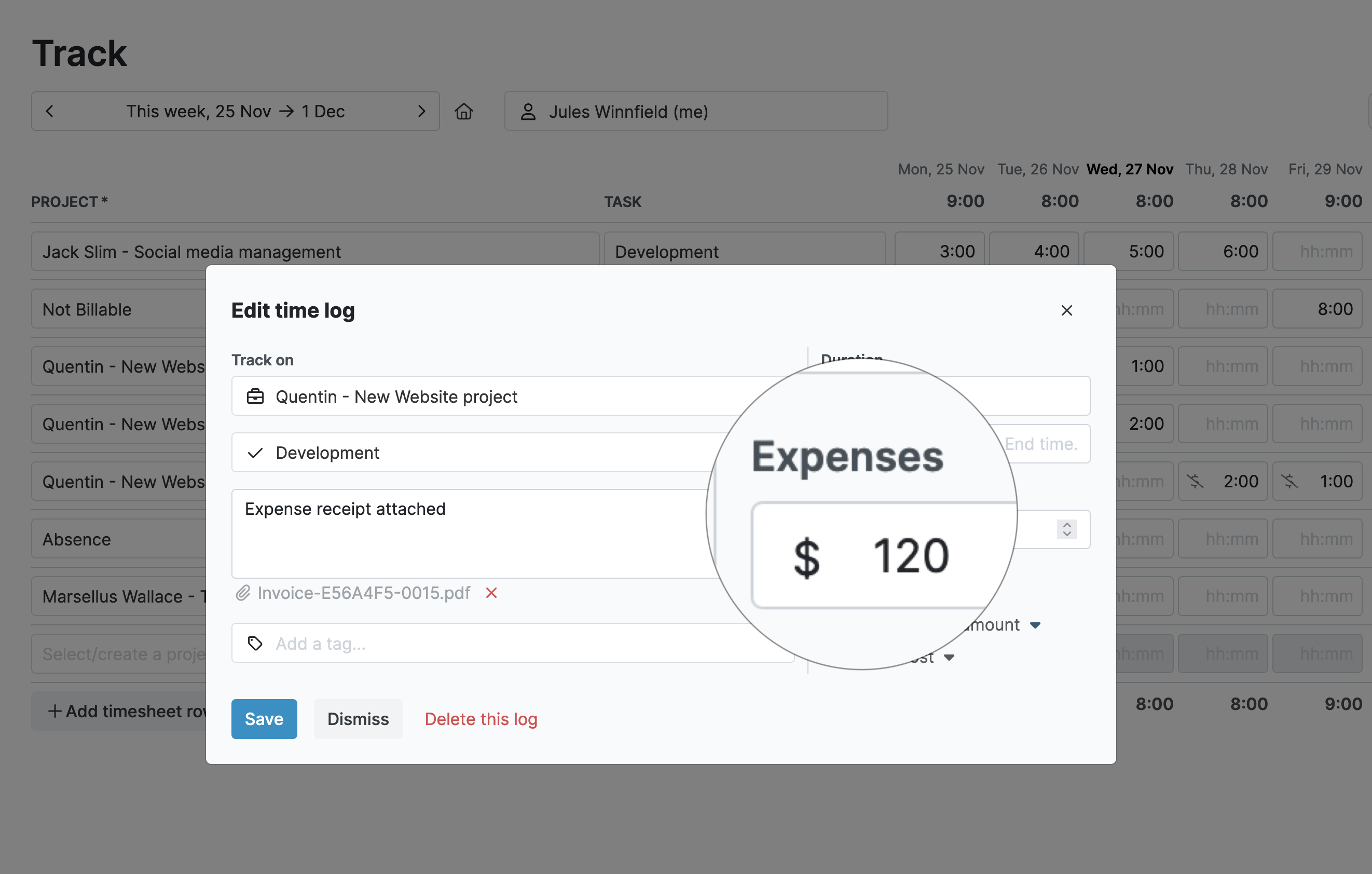

To do this in My Hours, you can set up different expense categories for clients, tasks, and projects. Importantly, you can also assign tags to expenses which will help you immediately identify which can and can’t be claimed.

To validate expenses, upload invoices and receipts. Doing this also keeps the data in one place and provides a transparent paper trail.

The My Hours mobile app has expense-tracking capabilities, making this process extra convenient.

Real-Time Reporting and Insights

When tax season rolls around, preparation is key. The beauty of My Hours is that you can generate reports at the click of a button, saving considerable time and energy.

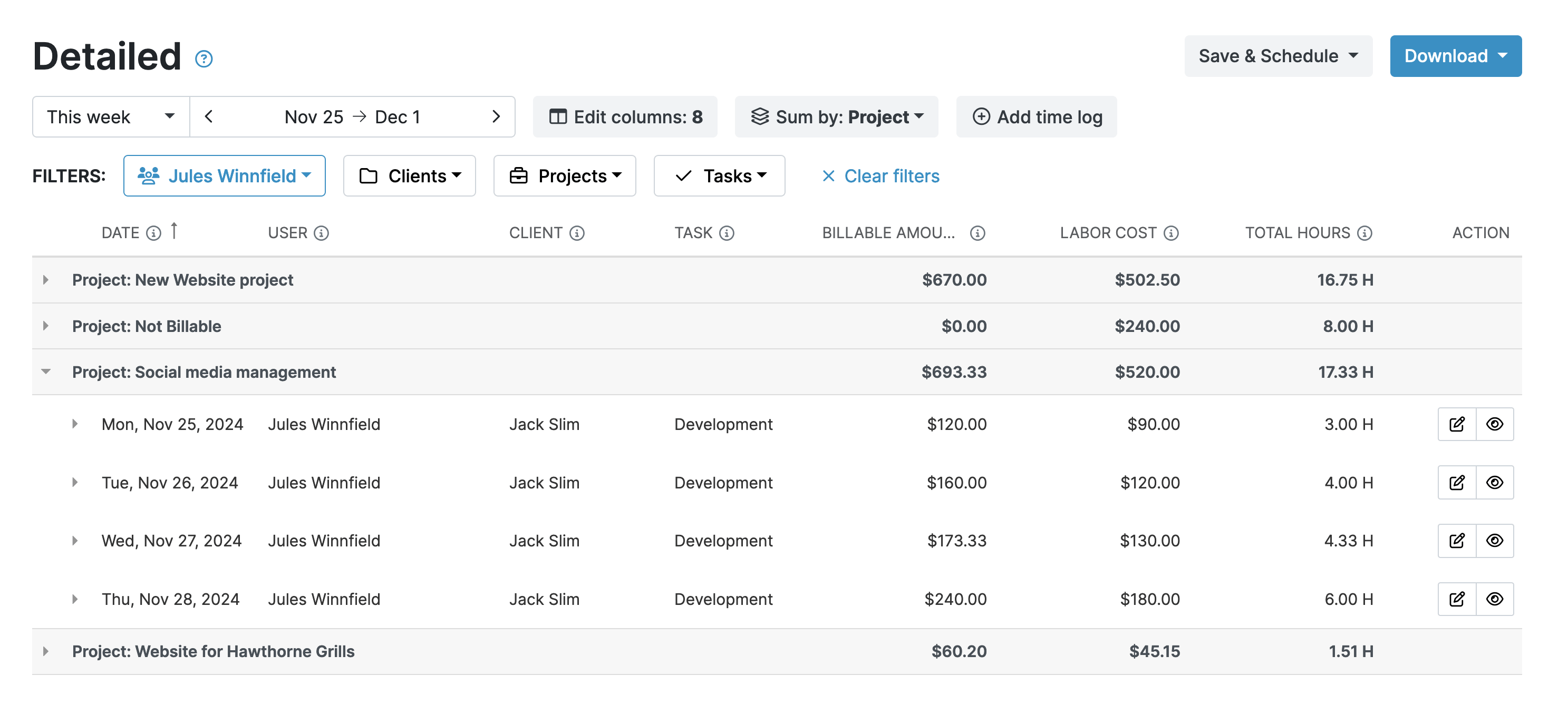

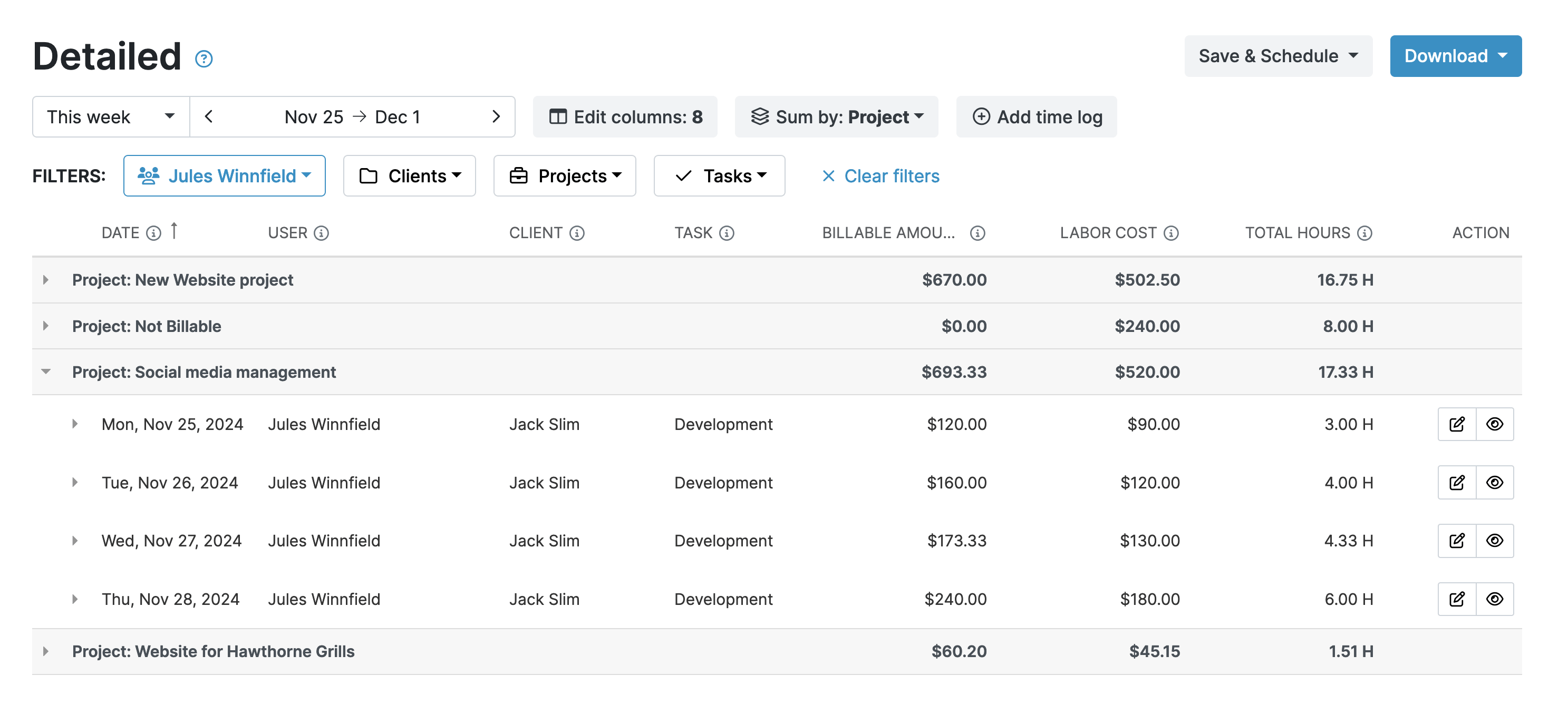

Although multiple reporting types are available within the app, the detailed report will be most suitable for R&D tax credit reporting requirements.

The reason for this is that not all activities you track will qualify for the tax credit. Therefore, you will only be required to report on those that do qualify.

The detailed report lets you select exactly which data columns you need and filter the results accordingly. It can include as much or as little data as required. Better still, it’s possible to save the report settings to make subsequent reporting even faster.

Reports can be pulled into XLS format which is ideal for showing lots of data. Or, for more basic overviews, you can generate an illustrated PDF document.

Accessible Yet Secure

Maintaining data integrity is imperative for successfully claiming R&D tax credits. Security is crucial for your organization when unauthorized access to this information can compromise the confidentiality of proprietary information.

Rest assured that My Hours takes data security and privacy very seriously. The app is ISO 27001 and ISO 9001 certified and complies with data privacy laws in the USA and Europe.

At the user level, My Hours lets you create user roles that control who can see what data:

- Normal users can’t access or view data from other users.

- Manager roles can only view and manage data from the projects they are assigned to.

- Administrator roles can access and manage all user data.

Manager roles are flexible, and you have the ability to control which My Hours functions they have access to.

Tips for Implementing My Hours to Gain R&D Tax Credits

A time-tracking tool is only as good as the people who use it. To get the right data, you must ensure that your staff understand what is expected of them.

When you implement time-tracking, we recommend doing the following:

- Familiarize yourself with the specific activities that qualify for R&D tax credits in your jurisdiction. Review this annually since the criteria can change.

- Determine exactly when and how staff should complete their timesheets. Whether hourly, daily, or weekly, create a process that works for your organization.

- Run training sessions so staff understands exactly how to use the software and which tools are available to make time-tracking easier.

- Employees can be wary of time-tracking. Make it very clear why you are tracking time. Emphasize that it is not for surveillance or to micro-manage staff.

- Incorporate time-tracking training into your onboarding program so new starters know what’s expected of them.

- Assign a point of contact for the time-tracking process so people have someone to whom they can direct their queries.

- Make use of the automated reminder and approval features so you don’t end up with gaps in the data.

Final Thoughts

In conclusion, integrating My Hours into your R&D operations not only simplifies the process of claiming tax credits but also fosters a culture of precision and accountability.

Having an effective time-tracking tool in place means your research department can focus on innovation with confidence, knowing that all efforts are meticulously tracked and optimized for financial benefits.