What Is the New Overtime Rule for Non-Profits?

In the spring of 2024, the Department of Labor (DOL) implemented a rule that increased overtime pay eligibility for workers.

The new rule forms part of the Fair Labor Standards Act (FLSA) and stipulates that employees earning a salary that falls under a certain threshold will be entitled to overtime pay.

The overtime pay must be at least 1.5X the employee’s usual rate for any hours worked beyond a 40-hour week. So, if an individual works 46 hours a week and earns $20/per hour, they will be entitled to $180 overtime pay.

It’s worth noting that this rule has always been in place but the salary threshold has so far been based on the 20th percentile of average earnings in the lowest-wage region in the USA.

The new rule now bases the threshold on the 35th percentile, with future increases occurring every three years in line with inflation.

What Are the New Thresholds?

Currently, for an employee to be exempt from overtime pay, they must be earning at least $684/week or $35,568/year. This is known as the Standard Salary Threshold.

The new rule, however, will increase the threshold over the coming years:

On each of these dates, employees who are paid below these salaries will be eligible for overtime pay.

Additionally, there will be an increase in the annual salary threshold for employees who qualify as a Highly Compensated Employee (HCE).

Currently, an HCE is exempt from overtime if they earn $107,432/year or more. The new rule will increase the minimum salary threshold as follows:

On these dates, HCE employees paid below these salaries will be eligible for overtime.

How Will This Change Impact Non-Profits?

Unfortunately, non-profits are not exempt from the new thresholds and must pay overtime according to the rules.

The National Council of Nonprofits analysis predicts that the rule will convert 460,000 nonprofit workers from exempt to non-exempt, resulting in an extra $44.8 million in overtime paid to non-profit workers.

This averages out to around $1,777 per worker in 2024.

Why Is This a Problem?

The US non-profit sector is massive and employs roughly 10% of the US working population (over 12 million individuals), so we’re talking about a lot of people who suddenly find themselves eligible for extra pay.

The new changes mean that non-profits face a choice – either keep individual hours the same and pay the increased costs. Or, find ways to reduce workloads so everyone stays within their 40-hour work week.

There are key issues at play, though, that make both of these choices challenging.

Most non-profits are chronically understaffed, and existing staff must pick up the extra workload, which means consistently working more than 40 hours per week. Staff turnover is high, mainly due to non-profits' inability to offer competitive salaries, further compounding the lack of resources.

How Non-Profits Can Manage the Change With My Hours

To manage the change effectively, you need data. Without a clear understanding of budgets, costs, and time spent, it's hard to see where you can make adjustments and efficiencies.

Using a tool like My Hours will make this job a lot easier.

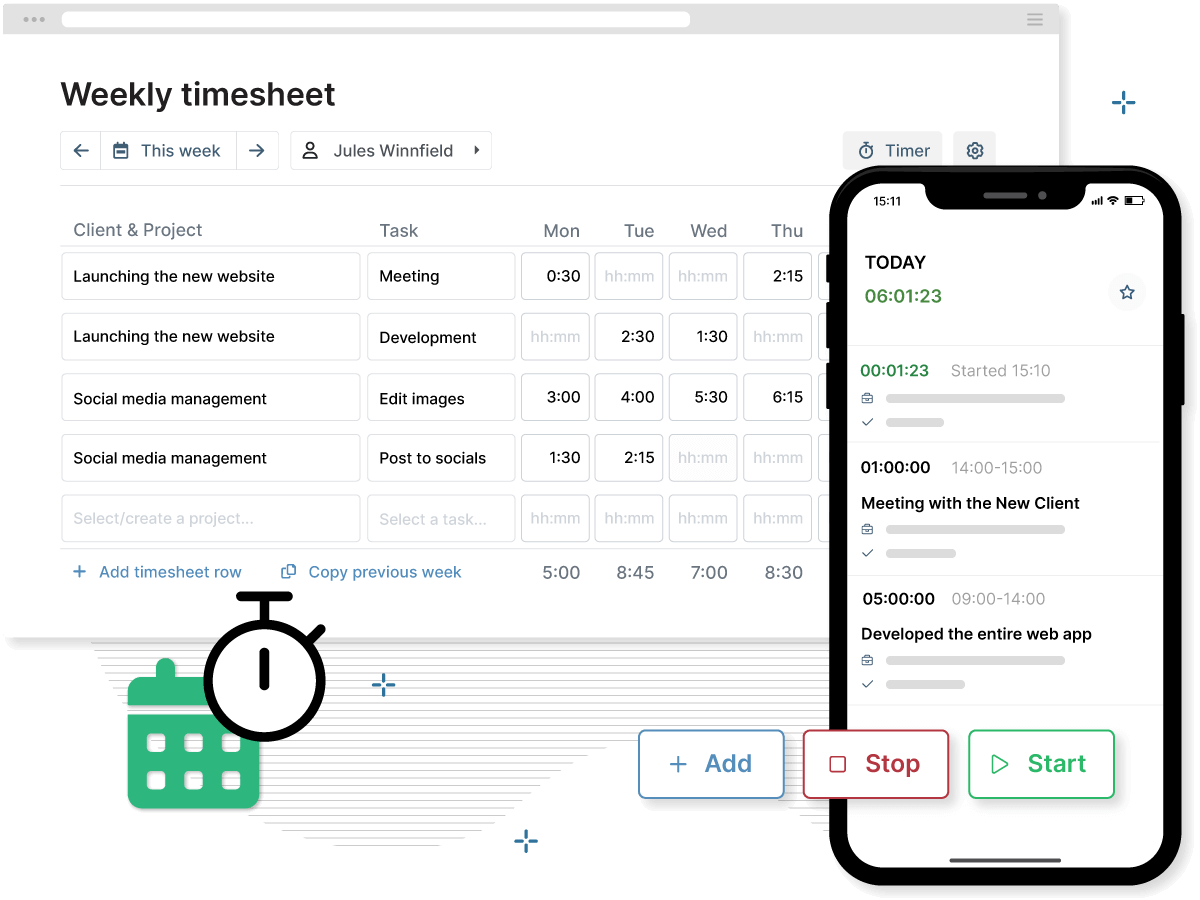

My Hours is a full time tracking system that allows you to understand how every minute of your staff’s time and every cent of your budget is spent.

By using the data and features in My Hours, you can make the new overtime rule as painless as possible.

Review Current Overtime Rates and Salaries

Now is the time to start reviewing salaries and potentially make adjustments. In fact, you should make this task a priority.

Weigh up the potential cost of overtime against the cost of raising staff salaries.

Some salaries may be sitting just below the threshold; therefore, it may make financial sense to raise them to just above the threshold so they become exempt from overtime pay.

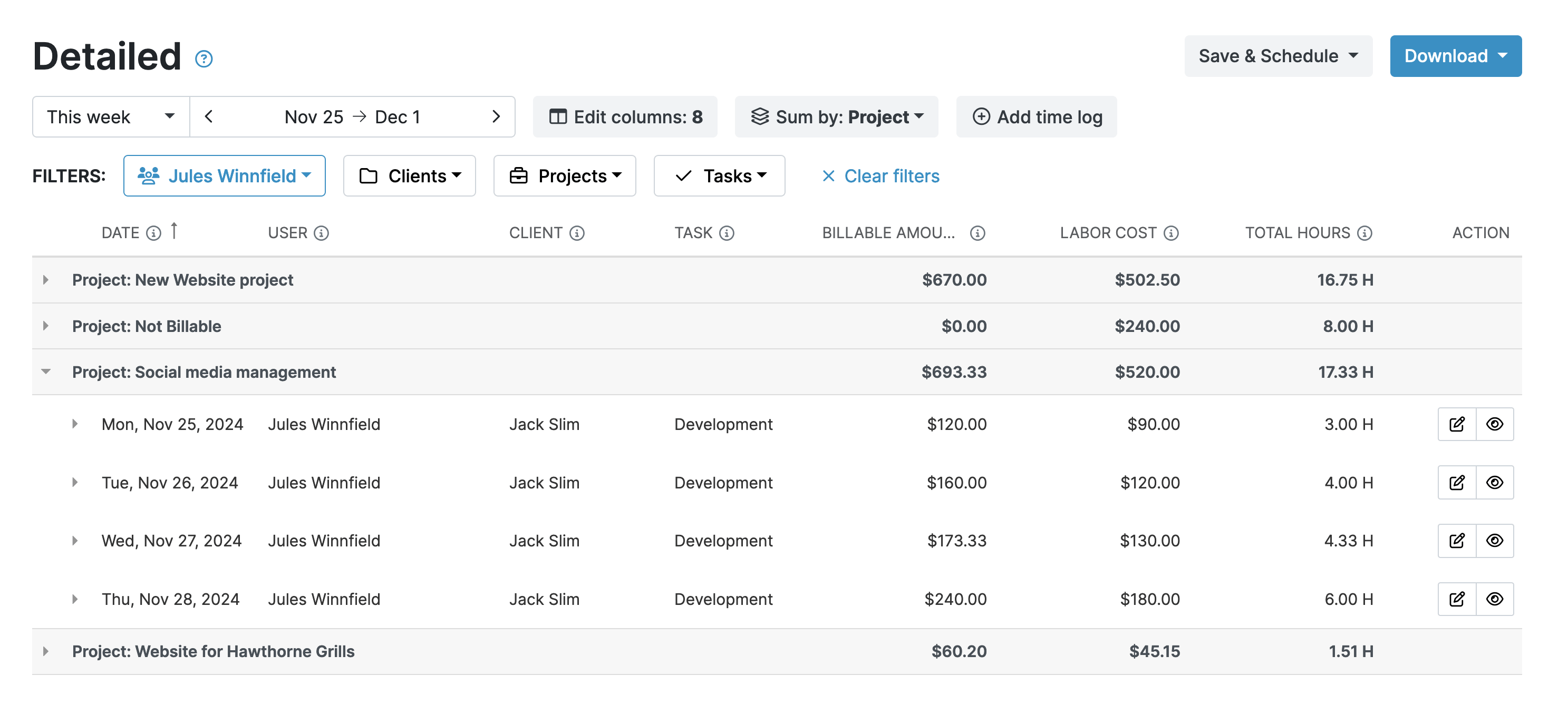

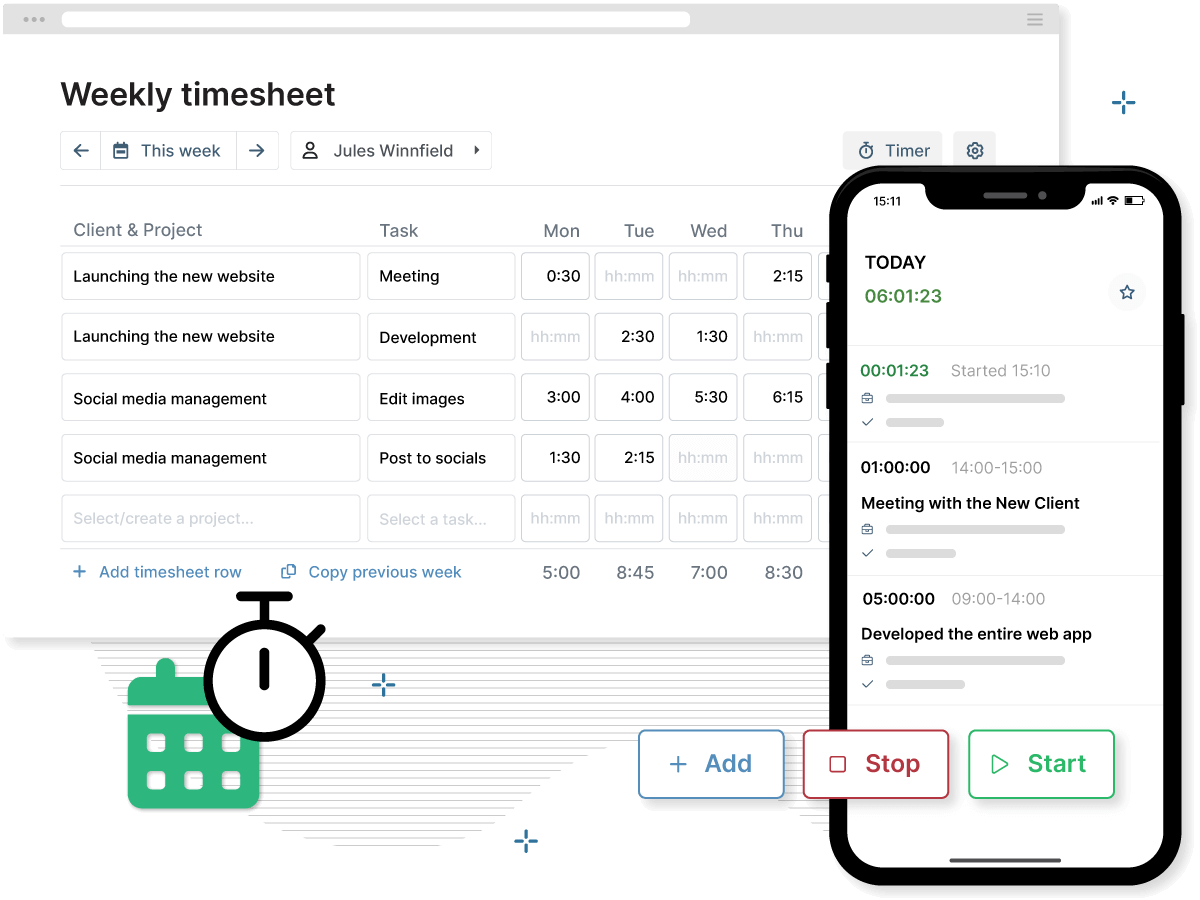

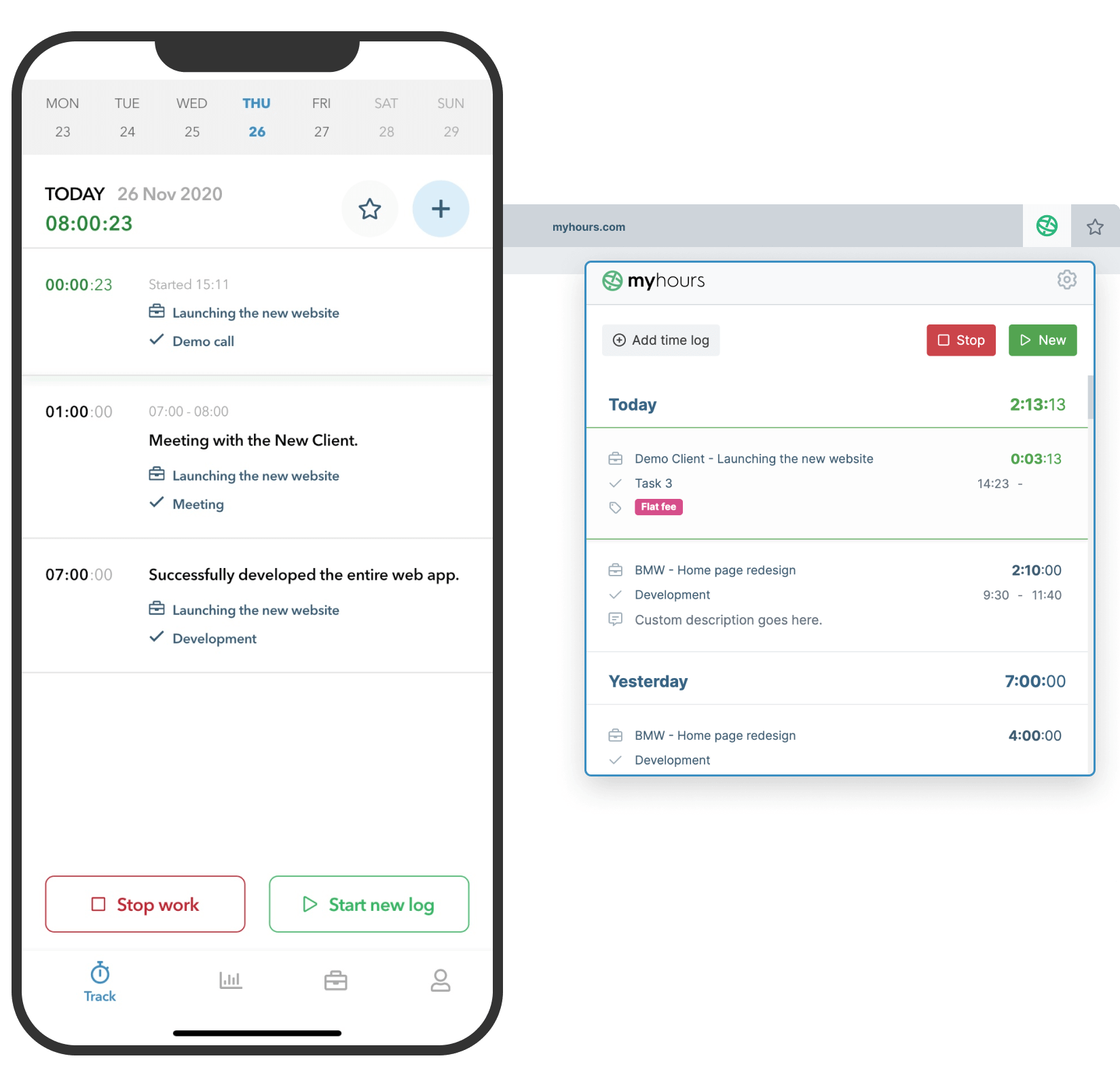

The real-time time tracking capabilities of My Hours will tell you exactly how many hours each individual is working each week – along with how much overtime they are clocking up.

Additionally, My Hours lets you set labor rates for each of your staff members. Then, when they track their time, you can quickly see what this extra time amounts to in cost.

This gives you a clear picture of how much overtime you are paying for each individual.

Compare this cost with the cost of a salary increase and you’ll quickly see which one is going to be the more cost-effective option.

Monitor and Control Overtime

If you weren’t paying too much attention to the amount of overtime worked before, then you certainly need to start doing it now.

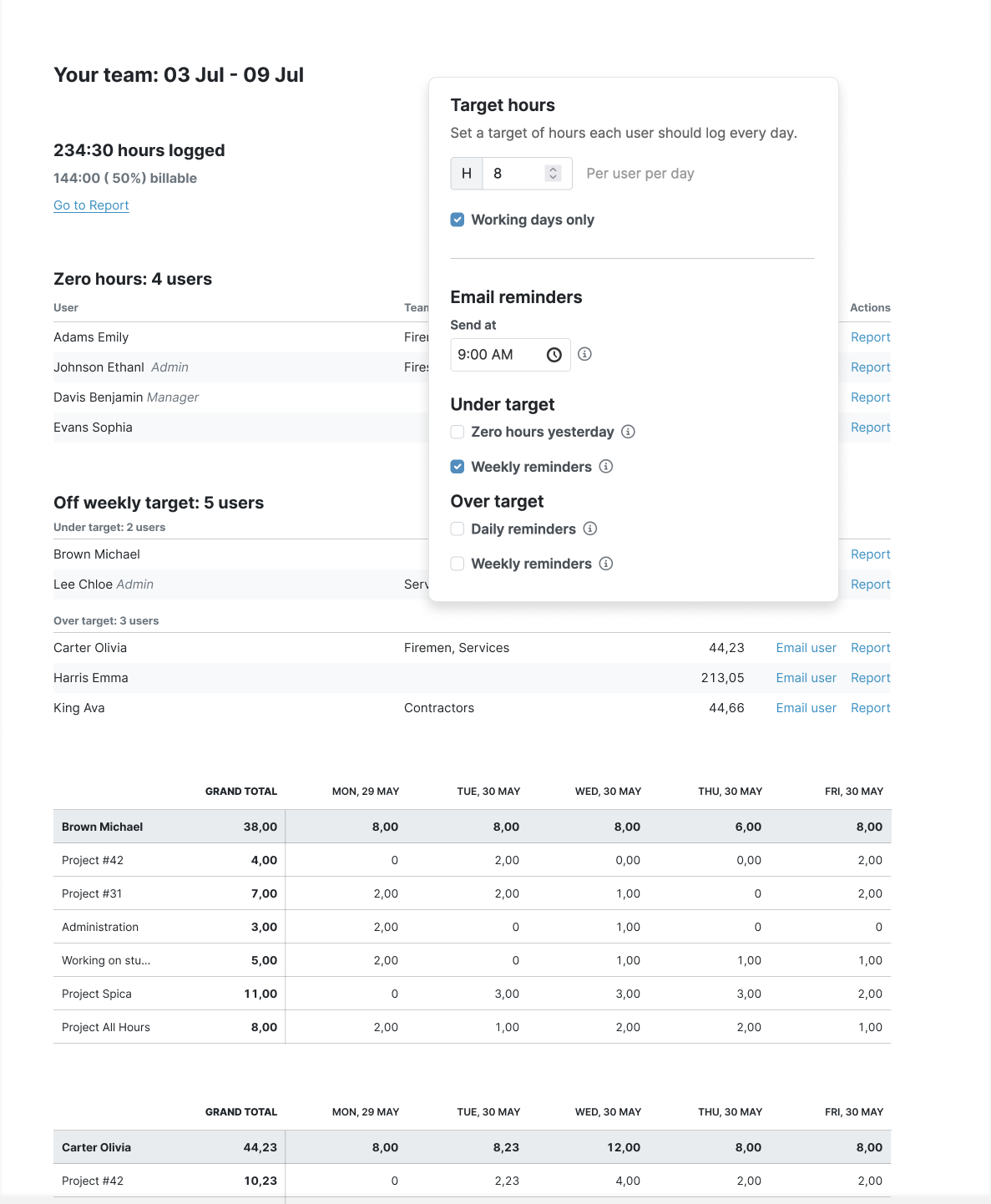

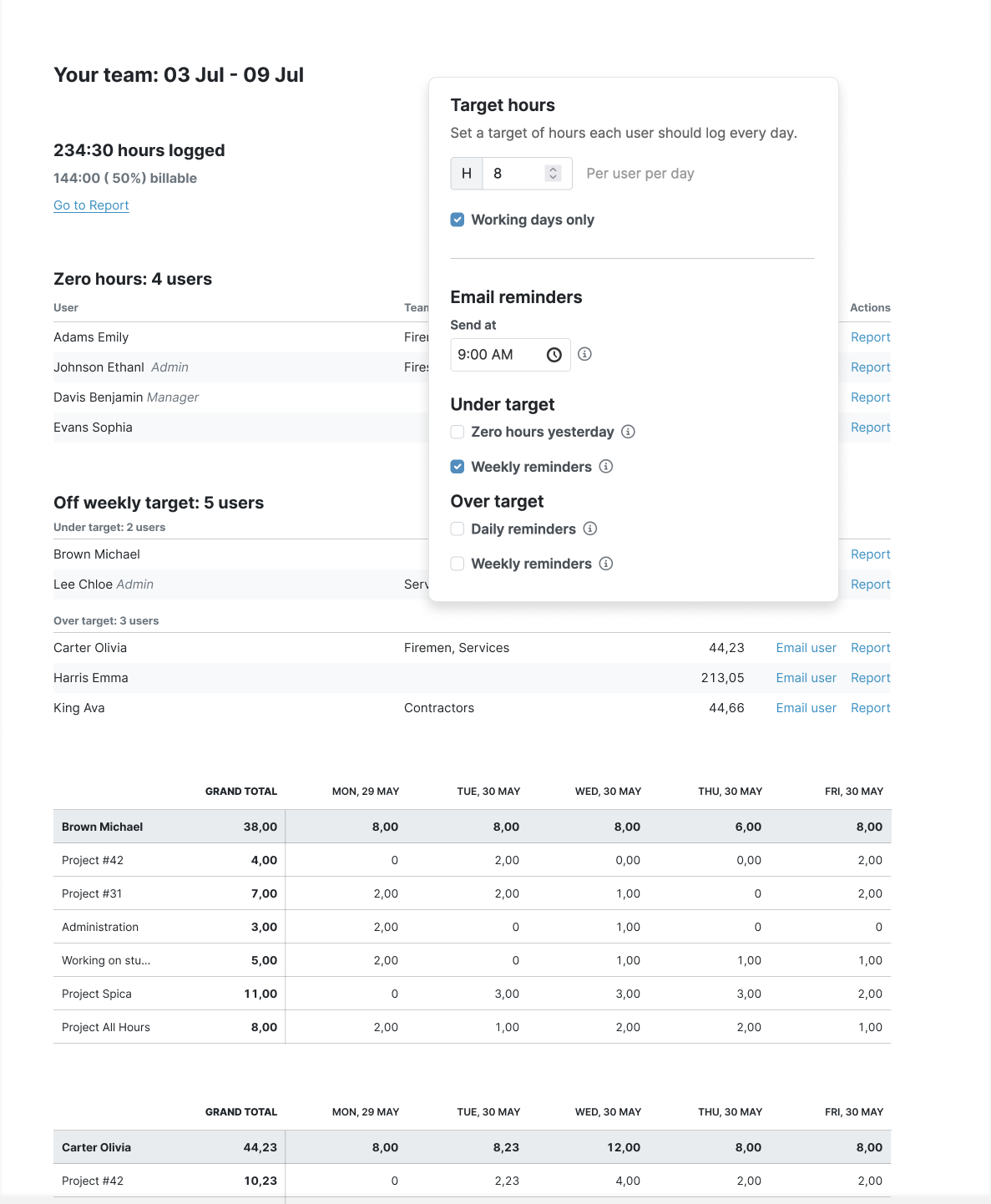

This is easily achieved in My Hours. You can set a daily target on the number of hours someone should work. Then, once the individual has clocked sufficient hours, the system will send out an email alert to say so. Alerts can be sent on a daily or weekly basis.

Those who are using the My Hours mobile app will also get a ping to notify them, making it even easier to stay on track timewise.

All My Hours administrators receive a weekly overview email every Monday that tells them which staff members exceeded their target hours in the previous week.

Review and Adjust Your Overtime Policies

It’s also time to pay attention to your policies regarding working hours. If staff have been clocking up a lot of overtime then you probably need to place a cap on it.

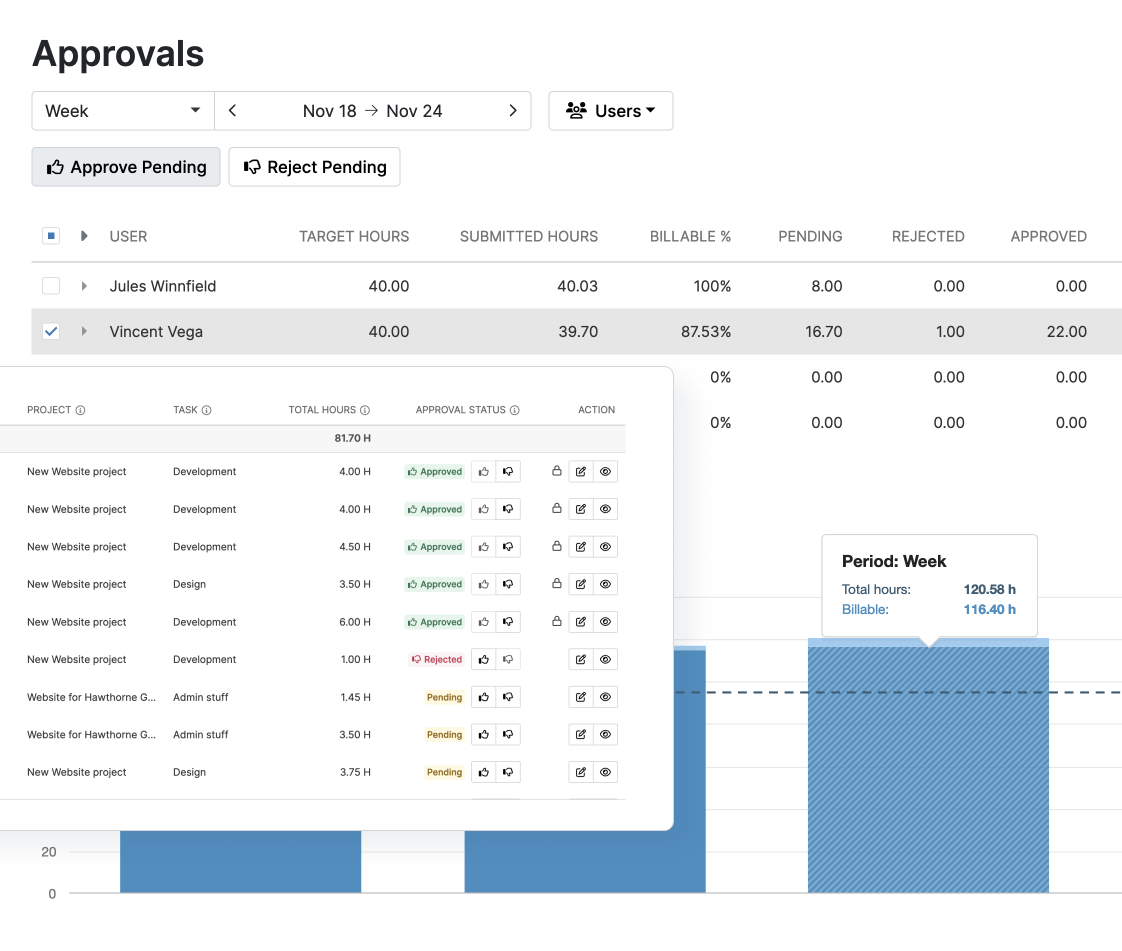

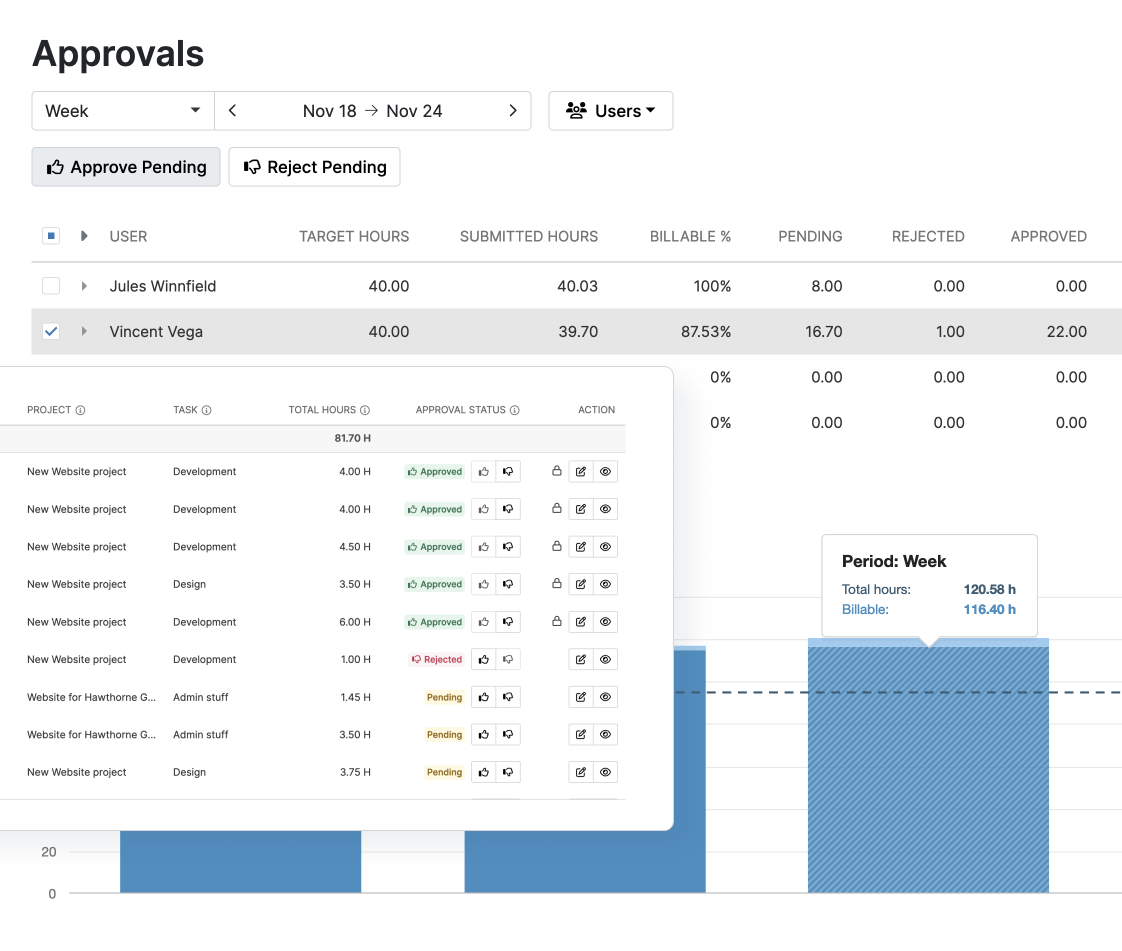

In addition to the overtime alerts, My Hours also lets you set up timesheet approvals.

When a staff member submits their timesheet, it can go to one or more supervisors for approval. Before it is approved, it can be edited. After approval, it gets locked and cannot be changed.

So, if you create a policy that clearly states how many overtime hours can be clocked and paid for, you can use the timesheet approval process to control it. State that timesheets with too many hours will not be approved and, therefore, have to be adjusted to within the acceptable range.

You should also be very specific in your policy about what is and isn’t considered permissible overtime.

To ensure that staff are tracking overtime for permissible reasons, they can set up a specific project or task for this purpose. Not only does this track the overtime in the right place, but it also means they can stop the real-time tracking clock once they have clocked the maximum number of overtime hours outlined in your policy.

Introduce Flex Time

Flex time provides staff with the ability to work to a looser schedule while still fulfilling their weekly quota of working hours.

For example, your organization has an event coming up on Saturday that requires all hands on deck – and a full day of work. Typically, staff work Monday through Friday, so working on Saturday would normally be recorded as overtime.

However, with flex time, workers could take the day off on Monday (when the office is generally quieter) and work on Saturday instead. That way, they still work their 40 hours but don’t rack up any overtime costs.

Sometimes it can be difficult to predict busy times but it helps to use the historical data in My Hours to spot the patterns. Using the detailed report will show you this information.

And, of course, time is easily tracked in the app, no matter the day or where the staff member is based.

Other features that help support flex time or remote work include:

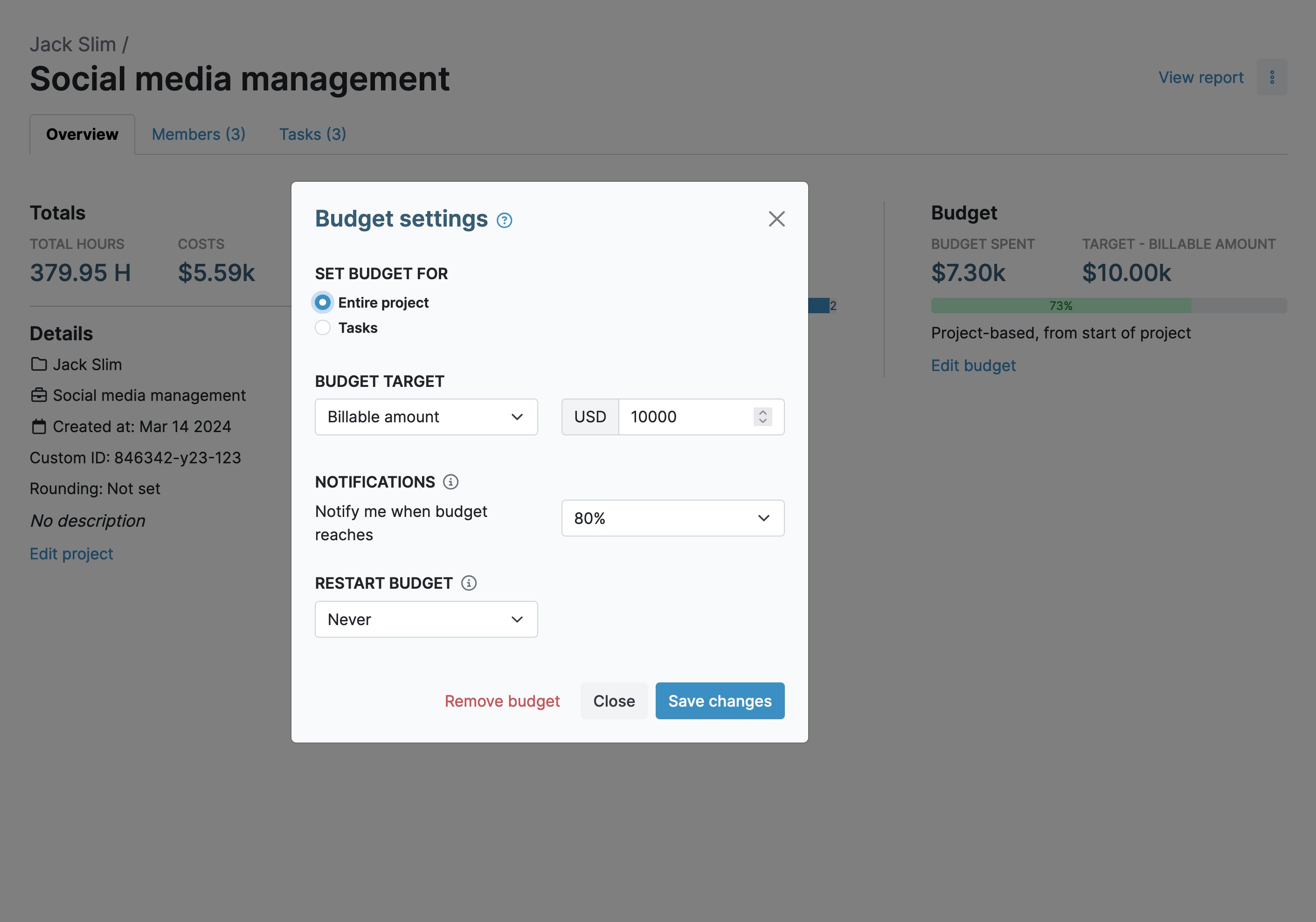

Review and Optimize Budgets

Since non-profits are unable to pass increased costs onto the people they serve, it means they have to get creative with the budget. This includes finding ways to reduce costs to accommodate the extra overtime expenses.

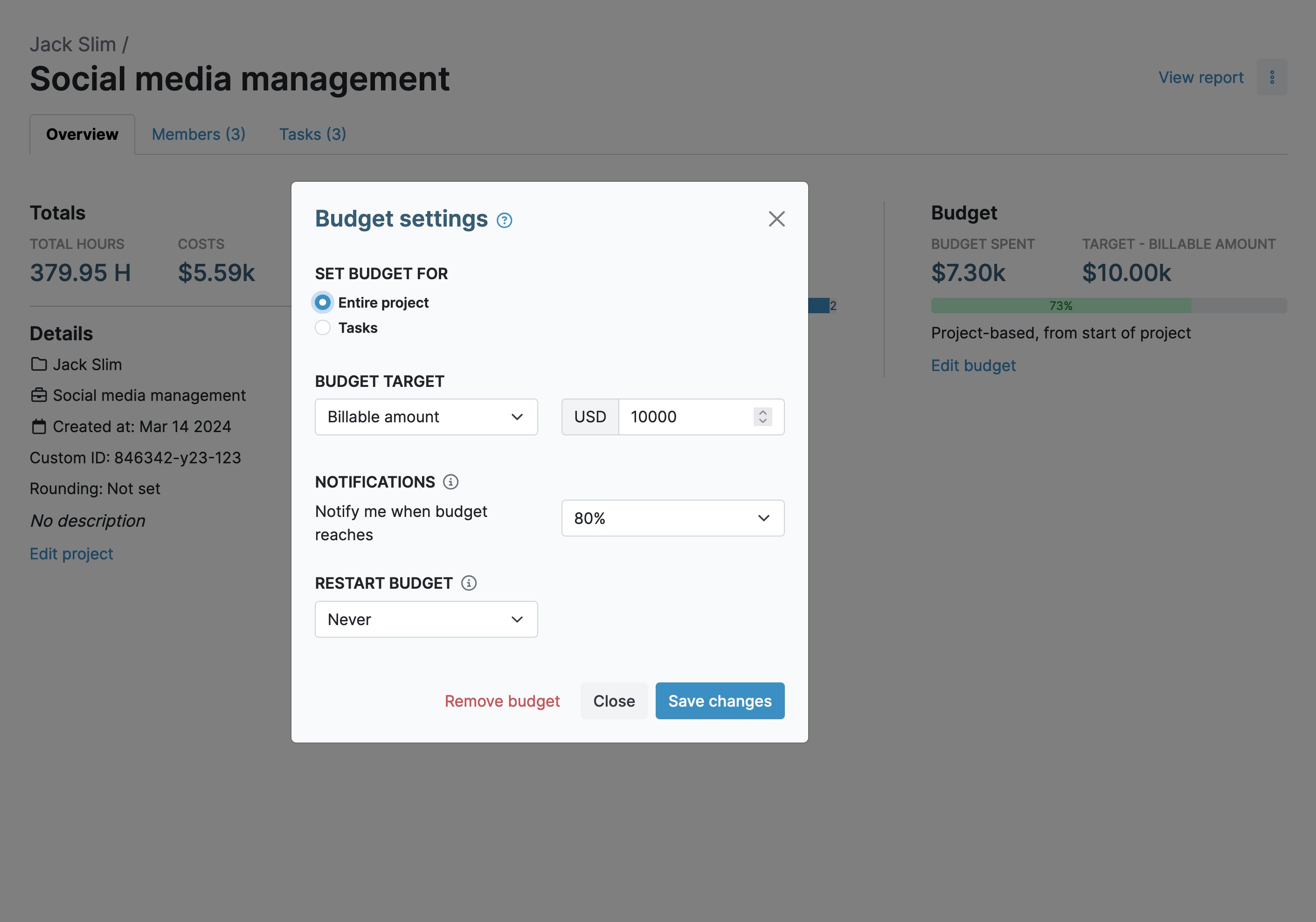

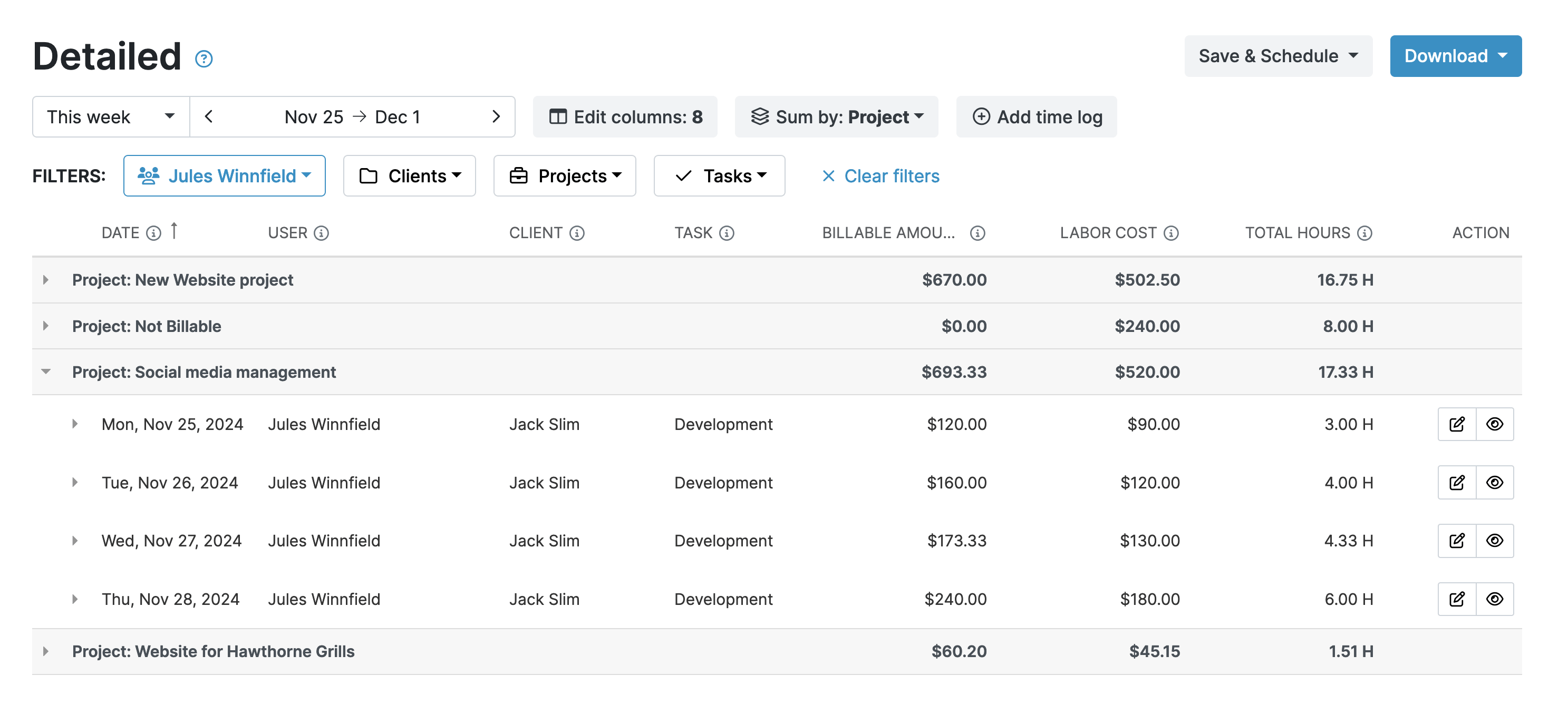

My Hours can help with this. Since you can assign labor rates, budgets, and expenses to clients, projects, and tasks, it gives you precise oversight on where money is being spent.

You can then review budget expenditure against the time spent on deliverables. This allows you to understand in which areas budget expenditure is efficient and where it is wasted.

To examine the data, you can pull a detailed, customized report from My Hours.

When you spot an inefficiency, make the necessary changes. For example, there may be too many workers assigned in one area and not enough in another.

Final Thoughts

It’s already a legal requirement for non-profits to keep meticulous records of time spent. Unfortunately, many organizations still rely on manual methods to do this.

Switching to My Hours will provide a convenient – and accurate – way to gather time records. You’ll also get access to that all-important data and make the changes necessary to tackle the new overtime rule.