Why Time-Tracking Is Critical for Non-Profit Rules and Regulations

Non-profit grants are typically given for a specific project or program. This means they come with strict guidelines and rules on how the funds can be utilized.

Moreover, grant funds typically can’t be used indefinitely. There is usually a specific period defined in which all activities and deliverables must be accomplished.

If a non-profit cannot demonstrate proper usage of funds or fails to comply with non-profit law, it runs the risk of having its grants revoked. It may even have to pay back funds and/or be blacklisted from future funding opportunities.

However, all of this is easily preventable.

Accurate time tracking acts as proof and validates that grant funds are being used appropriately. It also demonstrates that the non-profit is adhering to the terms of the grant agreement. This is so there can be no doubt that full compliance is being maintained at all times.

My Hours: A Simple Solution for Non-Profit Rules and Regulations

Transparency Over Fund Allocation and Use

A non-profit spends a significant portion of its funds on staff and payroll. Out of the $2 trillion non-profits spend annually, over $826 billion goes toward paying salaries, benefits, and payroll taxes. This is according to the 2019 Nonprofit Employment report.

Non-profits must prove this money is spent appropriately and on the projects outlined in the grant terms. Therefore, it’s essential to maintain full transparency in what paid staff do with their time.

My Hours provides real-time tracking capabilities on its timesheets. This is so staff members can effortlessly record how they are spending their time:

This provides up-to-date and fully transparent timesheet data. to assure stakeholders that their funds are being used appropriately. It also proves that grant terms are met and that rules and regulations are followed.

Showing how each minute is accounted for maintains trust and credibility among stakeholders. It also creates opportunities to secure additional funding.

Maintaining Financial Accountability

The budgets allocated to projects within a non-profit operate on very tight margins. Since funds are limited, there is no room to overspend.

Besides accounting for every penny, non-profits must also ensure they are complying with labor and tax rules and regulations. It is also crucial to adhere to governance laws around record keeping.

Moreover, funders specify where and how their grants can be spent within the grant terms.

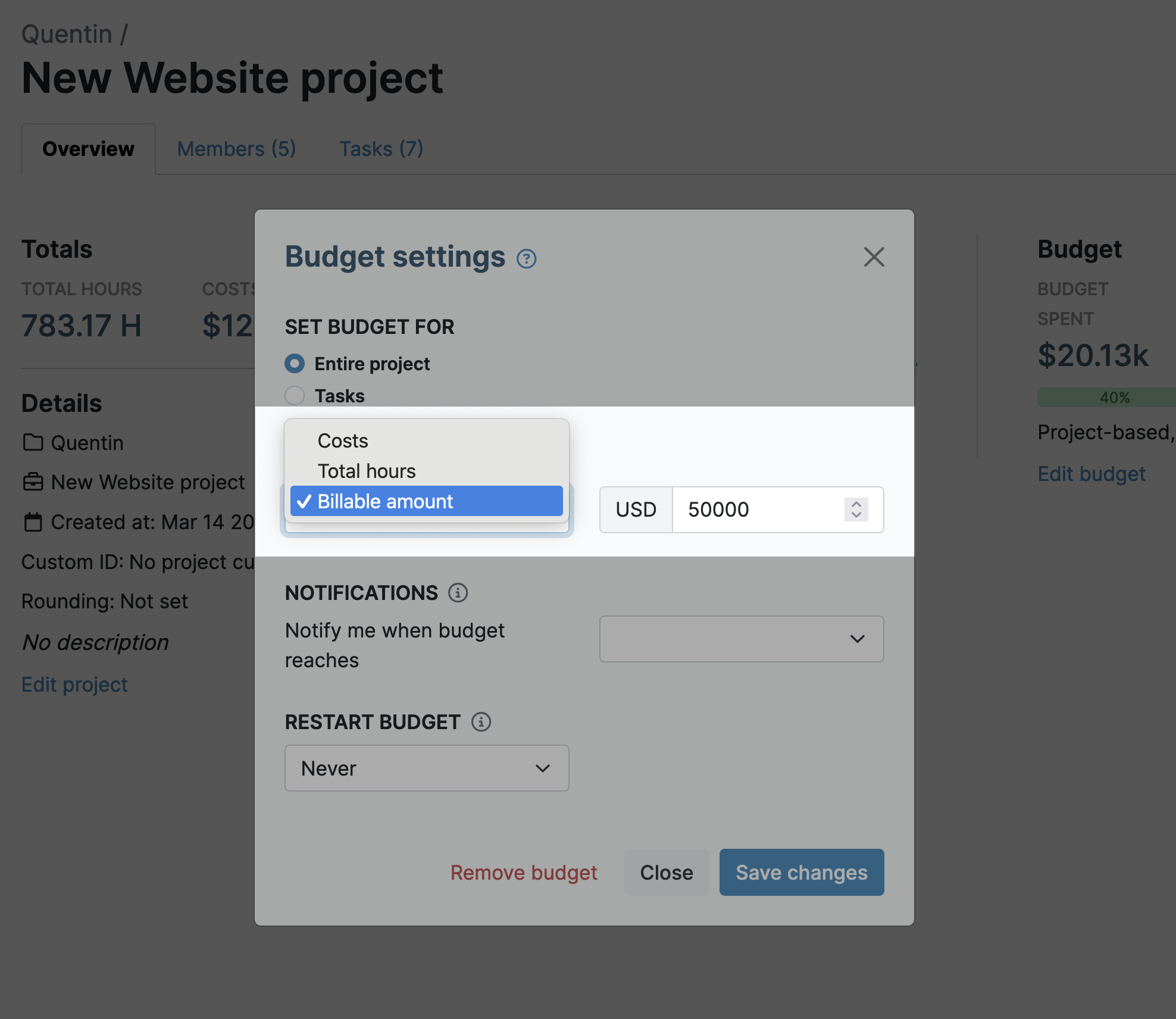

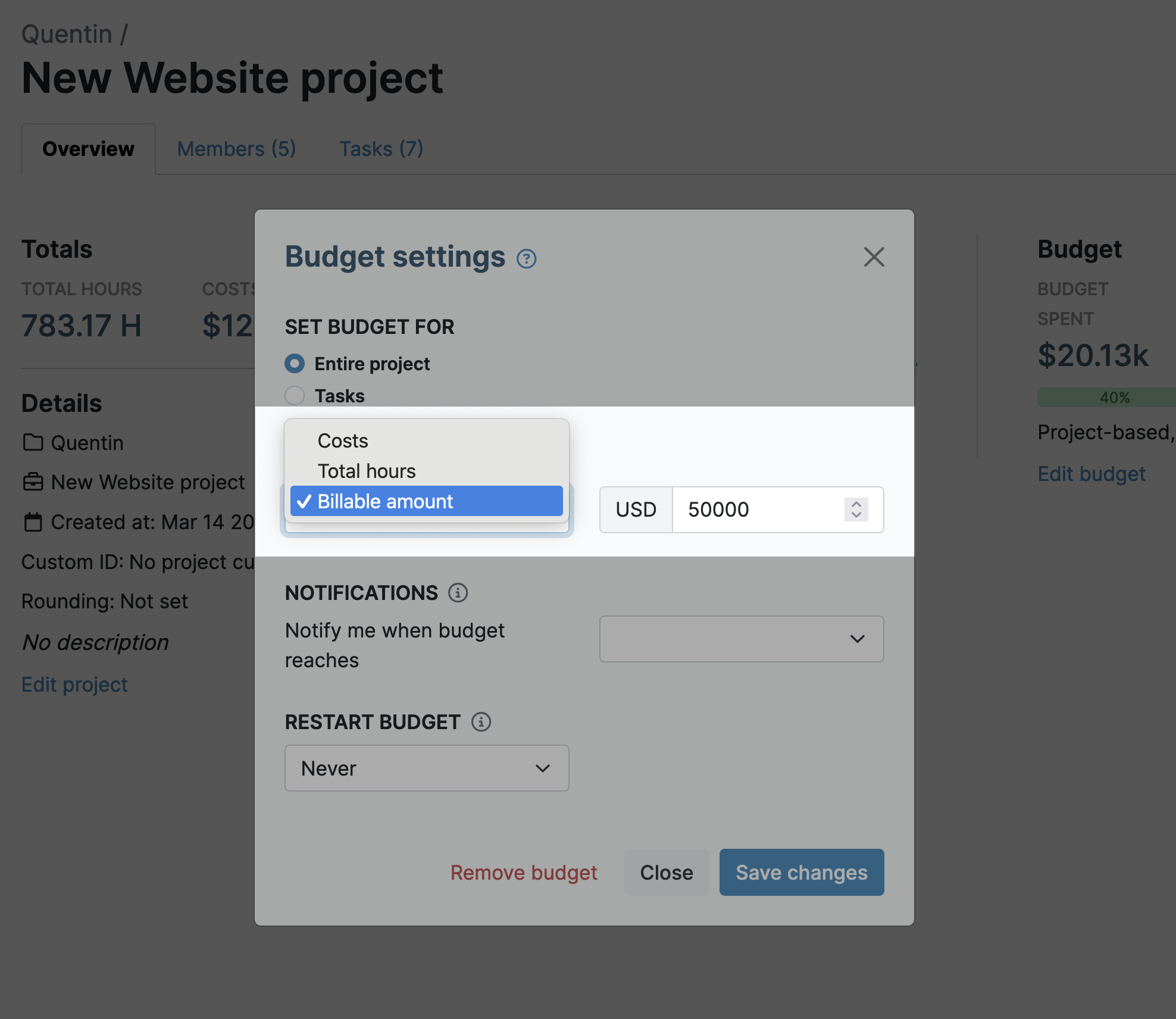

To maintain financial accountability, My Hours lets you set individual budgets for each project. These can be set in total hours, total billable amount, or total costs:

- For precision budget tracking, you can even break the total budget down to the task level.

- My Hours can automatically send an alert when a team member has logged their maximum hours. This helps prevent staff from accumulating overtime costs.

- My Hours will also automatically send an alert when 80% of a budget has been spent.

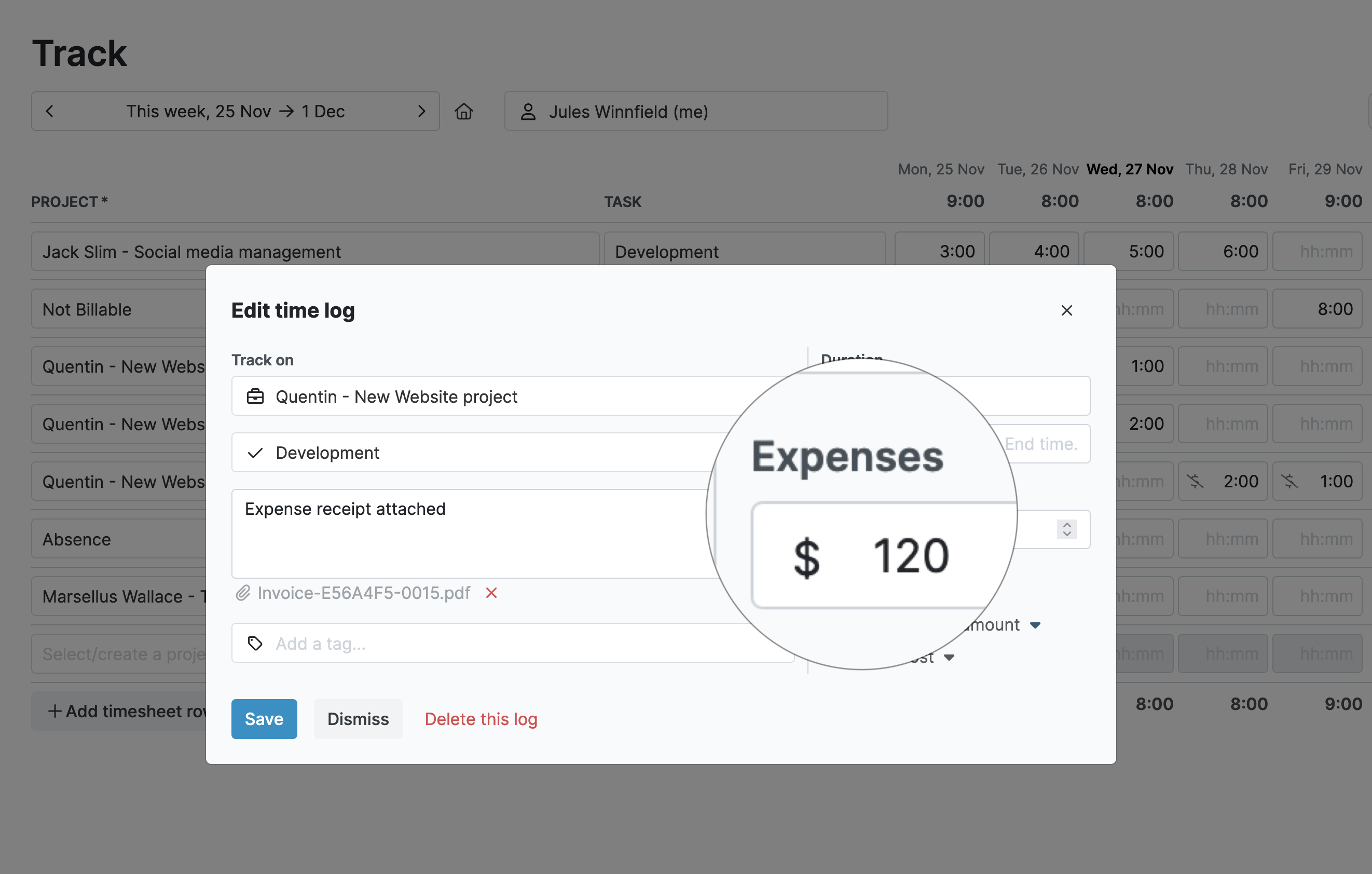

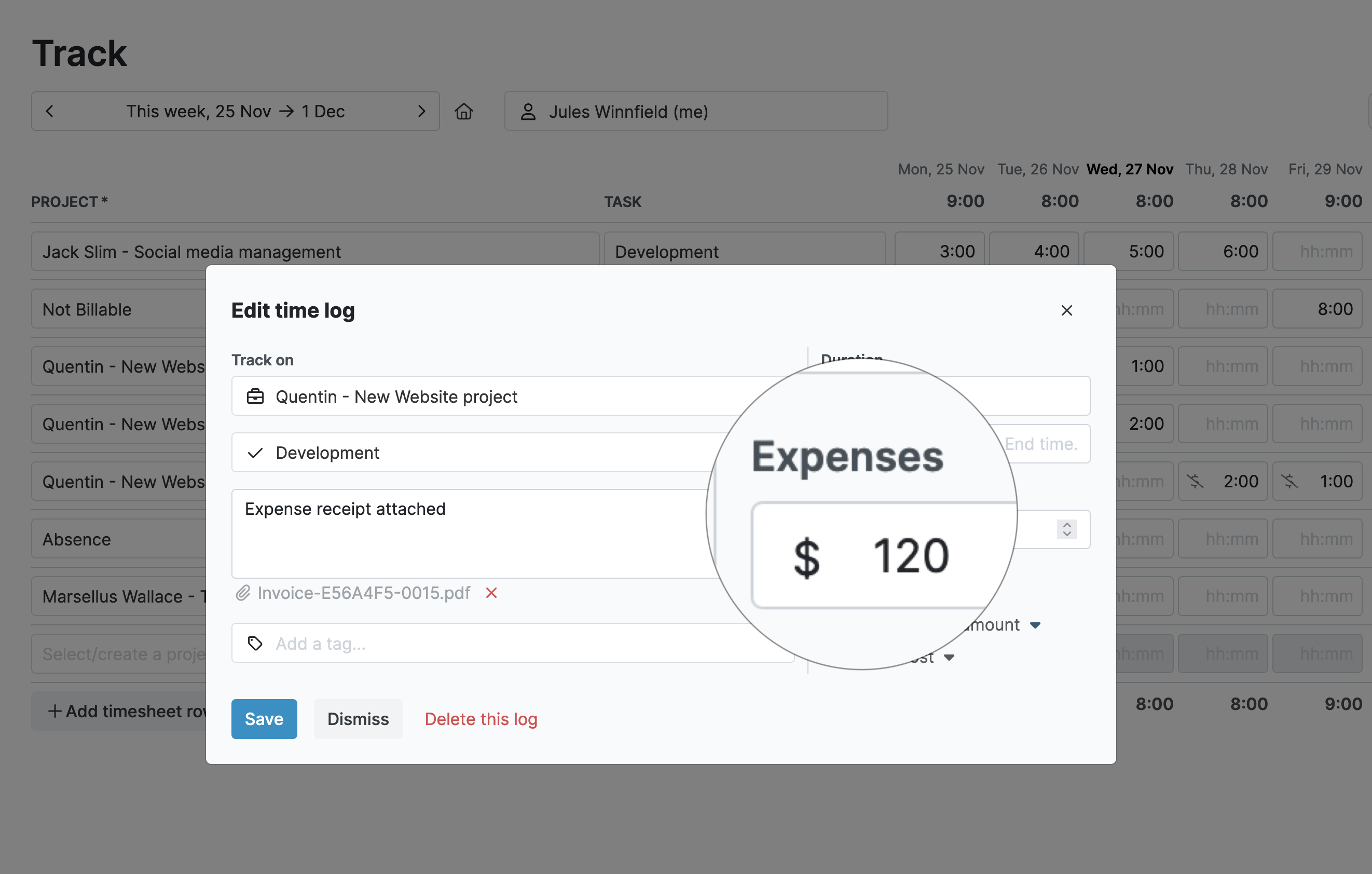

- Beyond staff expenditures, most projects accrue additional expenses. The purchase of material or equipment, for instance. To track these, non-profits can track expenses by creating expense categories by project, task, or tag.

- Corresponding receipts and invoices can be uploaded into each expense category.

- For staff who are on the road, the My Hours mobile app (Android and iOS) allows them to capture expenses on the go.

These features give non-profits full control over where the funds are allocated. Plus, they provide a top-down view of resource expenditure per project.

The data also helps determine ways to save money or find where it could be better allocated. Also, the accumulated historical data provides a goldmine of information. This can be used to make estimating budgets for upcoming projects more accurate.

Fulfilling Reporting Obligations

All grant rules and regulations mandate specific reporting requirements that must be fulfilled regularly.

The reports include breakdowns of all expenses – most notably, the payment of staff salaries or wages. It is also necessary to report on how resources are allocated. This includes how much time has been spent on grant-related projects and activities.

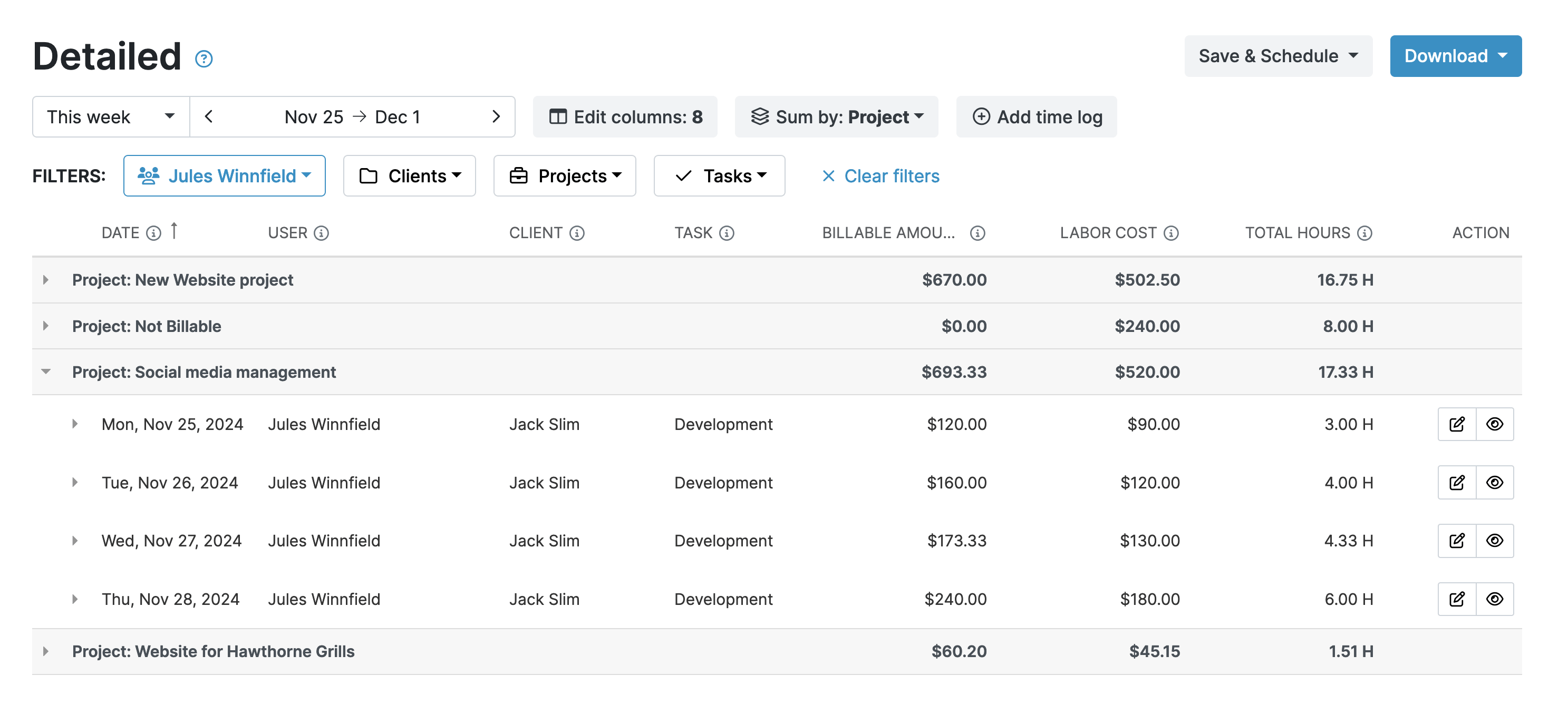

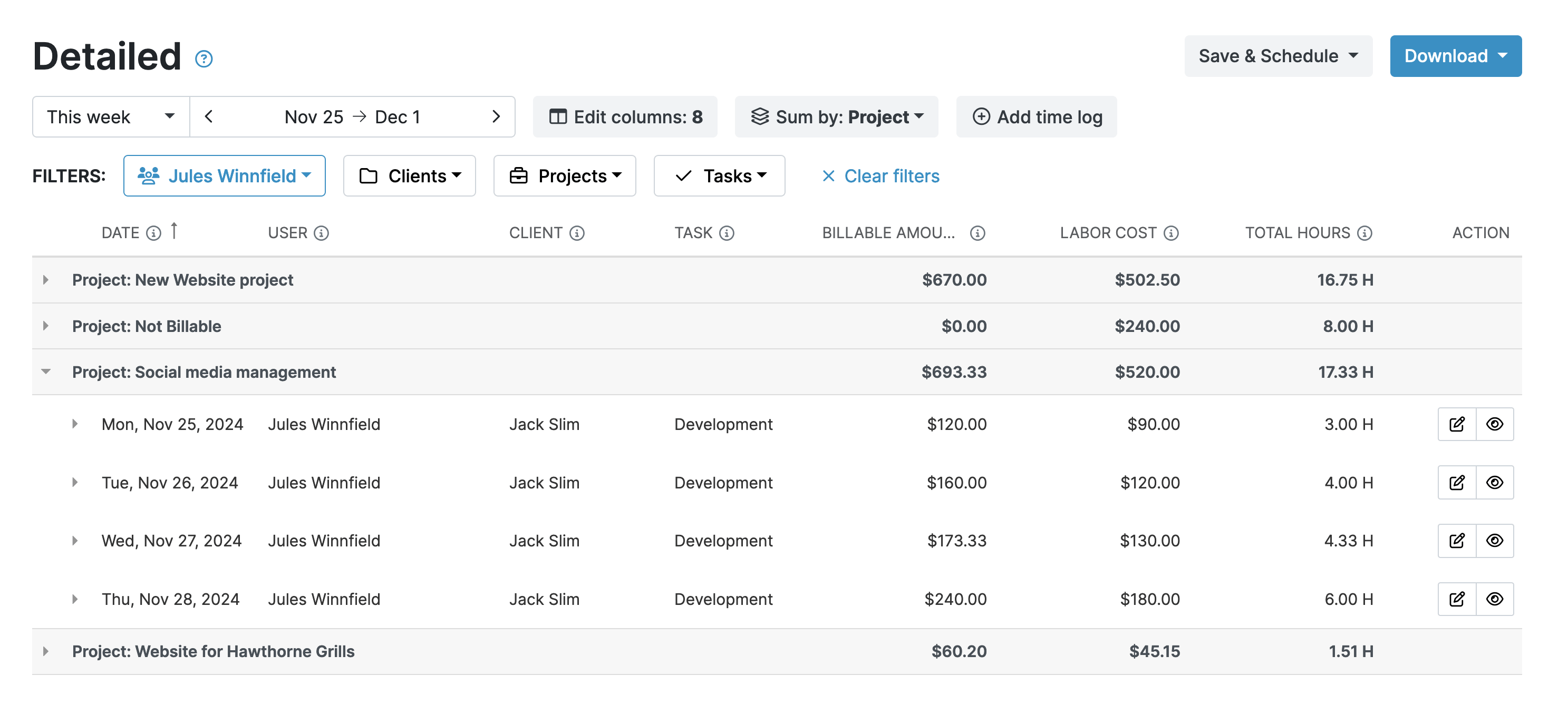

The benefit of using My Hours for all time, budget, and expense tracking is that all the data can be pulled into a report at the click of a button. Non-profits can tailor the data to match the reporting request.

- The detailed report provides a thorough breakdown of the data. It can then be highlighted or filtered as needed.

- The Projects tab focuses on the financials of the timesheets. It's great for understanding whether budgets and expenses are on track.

- Dashboard reports provide a summary of all time and expense tracking for a specified period. By day, week, or month, for instance.

- Timesheet reports break down the time spent by team members, projects, or tasks. This makes it easy to analyze where time can be used more efficiently.

My Hours also has a few neat features to make reporting even more efficient.

- To ensure data consistency, there is a handy reminder at the bottom of the dashboard report. It flags up anyone who hasn't submitted their timesheets.

- Saved report settings can be scheduled and automatically sent via email. This ensures a reporting deadline is never missed

- All reports can be generated in an easy-to-read PDF format (complete with colored graphs and charts). Or, the raw data can be pulled into an XLS format.

Compliance with Non-Proft Tax Rules

Non-profits are usually required by law to prepare and disclose financial statements to meet tax rules and regulations and maintain their tax-exempt status.

The level of detail depends on the jurisdiction and size of the organization. However, the statements typically have to be in line with GAAP or other applicable accounting standards.

For example, in the United States, most tax-exempt non-profits must provide an annual information return. Known as Form 990, it must be filed with the Internal Revenue Service (IRS).

Additionally, non-profits may have to disclose information about their activities, finances, and governance.

For non-profits that use different payroll and accounting platforms, My Hours also supports the use of Zapier. This tool connects My Hours to thousands of third-party apps to allow the automated transfer of data.

Audit Preparation

Because of a non-profit's increased accountability, audits are frequent. Audits are even more likely if the non-profit receives federal grants.

Some countries and jurisdictions have rules in place that make regular audits mandatory for non-profits.

Gathering or updating said documents ahead of an audit can be extremely time-consuming. If data is missing, it can take even longer to prepare everything.

However, using My Hours means you already have all the necessary data collated, organized, and ready to present at a moment’s notice. The time-tracking data will validate:

- Time and effort reporting, and whose time was charged to the grant funds.

- The projects, tasks, outputs, and outcomes that were achieved with the grant funds.

- An Audit Log where you will find details on when and how logs were added, when and how they were edited, and by whom they were approved or rejected.

.png)

Fraud Prevention and Detection

Rules for non-profit organizations often contain provisions to prevent waste and abuse of grant funds. Therefore, they may have to implement fraud prevention measures to safeguard against such instances.

Again, this is where My Hours can step in and provide a solution for this purpose. All the data entered into My Hours is clear and transparent so non-profits can demonstrate that the necessary controls are in place.

What Are the Consequences of Non-Compliance?

Should a non-profit be found non-compliant, the consequences can be swift and harsh. In the most severe cases, a breach in compliance may be enough to force the non-profit to shut down permanently.

- Increased Oversight: Auditors and stakeholders may start watching the non-profit's every move. They may also put corrective measures in place.

- Loss of funding: Non-profits can be declared ineligible for future funding.

- Repayment of Grant Funds: If funds are misspent, the non-profit can be forced to pay back some or all of the amount.

- Diminished Reputation: If the word gets out that a non-profit has misused grant funds, it can quickly destroy its reputation.

- Fines and Criminal Charges: Non-profits can receive hefty fines and even criminal prosecution or jail time.

Final Thoughts

In conclusion, My Hours is a great solution for ensuring that non-profit rules and regulations are met.

When non-profits adhere to their strict terms, it benefits all. It increases the positive impact on the served communities. Donors can feel confident that their money is being used wisely.

.png)